Gambling Commission Fines William Hill Record £19.2 Million for Serious Failings

The UK Gambling Commission has fined the William Hill Group a record £19.2 million (€21.8 million) for serious social responsibility and anti-money laundering failures at three of its gambling businesses.One new customer allowed to lose £20k in 20 minutes with no checks or customer interactions

According to the commission announcement, WHG International Limited (williamhill.com) will pay £12.5 million, Mr Green Limited (mrgreen.com) will pay £3.7 million and William Hill Organization Limited, which operates the group’s 1,344 retail bookmakers across the UK, will pay £3 million.

Social responsibility failures at the businesses include:

- Insufficient controls to protect new customers. One new customer allowed to spend £23,000 in 20 minutes without any checks. Another customer was allowed to spend £18,000 in 24 hours without any checks. Third customer allowed to spend £32,500 over two days without any checks. (Mr Green)

- Failing to identify customers at risk of experiencing gambling related harm – one customer lost £14,902 in 70 minutes. (Mr Green)

- Failing to intervene with customers at an early stage – one customer lost £54,252 in four weeks without checks of any kind. (WHG (International) Limited)

- Insufficient controls exposing new or returning customers to the risks – one customer opened account and lost £11,400 over the first 30 days without checks and another customer had no live customer support interaction until losses reached £45,800. (WHG (International) Limited)

- Failing to apply a 24-hour delay between receiving a request for an increase in a credit limit and granting it – one customer was allowed to immediately place a £100,000 bet when his credit limit had been set at £70,000. (WHG (International) Limited)

- 331 customers allowed to gamble with WHG (International) Limited despite having self-excluded with Mr Green. (WHG (International) Limited)

- Failing to identify changes in customer behavior. (William Hill Organisation Ltd (WH Retail))

- Insufficient controls to protect new customers, and to effectively consider high velocity spend and duration of play until the customer may have been exposed to the risk of substantial losses in a short period: Operator allowed one retail customer to lose £10,600 in two days without a safer gambling interaction. An unknown gambler wagered £42,253 in 130 bets over a three-day period with no safer gambling customer interactions. (William Hill Organisation Ltd (WH Retail))

Anti-money laundering (AML) failures include:

- Allowing large deposits without checks – one customer spent and lost £70,134 in a month, another lost £38,000 in five weeks and another lost £36,000 in four days. (WHG (International) Limited)

- Allowing large deposits without checks – one customer deposited £73,535 and lost £14,068 in four months. (Mr Green)

- Allowing large wagers without checks – No Source of Funds (SoF) evidence when customer staked £19,000 in a single bet, no SoF from customer who staked £39,324 and lost £20,360 in 12 days, no SoF from a customer who staked £276,942 and lost £24,395 over two months. (William Hill Organisation Ltd (WH Retail))

- Ineffective policies, procedures and controls following the results of customer profiling. (WHG (International) Limited) and (Mr Green)

- Procedures and controls lacked hard stops to prevent further spend and mitigate against money laundering risks. (WHG (International) Limited) and (Mr Green)

- AML staff training provided insufficient information on risks and how to manage them. (WHG (International) Limited) and (Mr Green)

Andrew Rhodes, Gambling Commission chief executive, said:

“When we launched this investigation the failings we uncovered were so widespread and alarming serious consideration was given to licence suspension. However, because the operator immediately recognised their failings and worked with us to swiftly implement improvements, we instead opted for the largest enforcement payment in our history.”

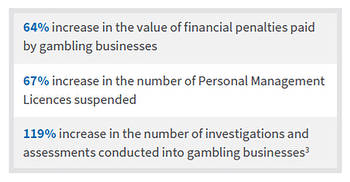

In the last 15 months we have taken unprecedented action against gambling operators, but we are now starting to see signs of improvement. There are indications that the industry is doing more to make gambling safer and reducing the possibility of criminal funds entering their businesses.

Operators are using algorithms to spot gambling harms or criminal risk more quickly, interacting with consumers sooner, and generally having more effective policies and procedures in place.”

This latest regulatory action follows the recent issuance of a £7.2 million fine on two operators that are part of Kindred Group plc. This latest fine is the biggest issued by the UKGC, surpassing the previous record of a £17 million fine issued to Entain in August of last year.

Since the start of 2022 the Commission has concluded 26 enforcement cases with operators paying over £76 million because of regulatory failures.

This brings the total fines for 2023 to more than £42million (€47.7 million) while the UKGC’s fines make up £33.8 million (€38.4 million) of that figure.

According to industry fines tracker website GamblingIndustryFines.com, gambling industry fines in 2022 came to €251,712,034 / $269,532,490 – a significant increase of 443.9% compared to 2021’s total of €44,753,969 / $48,642,992.

Ciaran McEneaneyBased in Galway, Ireland, Ciaran has over a decade of experience writing for some of the biggest names in the sports-betting, gambling, poker & casino industries.