From Blanket Bans to Blanket Regulations: Still No Differentiation on the Horizon

Blanket Online Gaming Regulation Bill Proposed

After a period marked by skirmishes between state governments and high courts over the constitutionality of blanket bans on online gaming, resulting in a number of outright prohibitions to offer games online getting struck down by the judiciary system, the Online Gaming (Regulation) Bill, 2022, was tabled at the Lok Sabha proposing a blanket regulatory framework over India’s gaming sector.

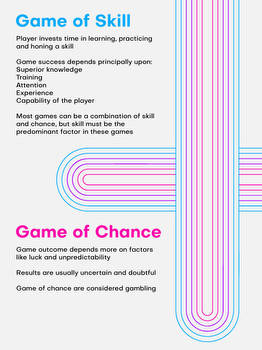

In its essence, the Bill has a blanket character as it proposes regulation under one umbrella of all modes of cyberspace gaming – ranging from online casino games for real money to casual gaming and esports containing certain real money features. Moreover, the Bill makes no distinction between the old categories of skill-based and chance-based gaming.

“It’s clear that M.P. Dean Kuriakose, who introduced the bill, could use the help of people experienced with regulated markets to gain a better understanding of how vastly different a game with real money features is from a game entirely based on real money activity,” as commented in a recently published analysis of the pros and cons of the newly proposed gaming bill.

“In short, an online casino shouldn’t be regulated in the same way as, for example, a gaming platform offering a first-person shooter game with optional real money features. These games are widely different, and trying to fit them under one umbrella is a recipe for disaster,” Felicia Wijkander, Editor in Chief at casino comparison platform SevenJackpots, writes.

The Online Gaming (Regulation) Bill, which was proposed on April 1 this year, envisages the creation of a national-wide licensing regime over all modes of gaming and the establishment of an Online Gaming Commission by the Central Government.

The Commission will be mandated to draw up the applicable rules and to oversee the functioning and operations of India’s gaming sector, as well as to propose adequate measures to curb illegal gaming in the country.

Blanket GST Levy Approach in the Making

After a year of considerations, the special Group of Ministers (GoM) tasked on May 25, 2021 to examine GST applicability and valuation over online gaming, casinos, horse racing and lottery has reportedly submitted its recommendations to the GST Council earlier in May this year. As per the reports, the GoM recommends a blanket approach bringing all gaming modes under the highest 28-percent GST rate slab together with a levy over gross gaming revenue (GGR) and not on the full transaction amounts.

Currently, online skill gaming platforms are charged with 18 percent GST, applicable to the operators fee or trading margin, or in other words the GGR, and not to the prize pool. The situation with chance gaming, casinos, race courses and lottery is more complex, where in many cases the highest GST rate is charged over the full transaction or betting amount.

“Keeping game of skill and game of chance at par and taxing both the games at sin rate of 28% will be detrimental to the nascent Indian online gaming sector,” L. Badri Narayanan, Executive Partner at Lakshimkumaran and Sridharan Attorneys, states.

“It is important for the GST Council to adopt appropriate GST rate and valuation mechanism. The well-established legal jurisprudence of the Supreme Court treating game of skill different from game of chance, should be taken into account by the Council before determining GST rates and valuation mechanism.”

Moving in the Right Direction, Generally Speaking

“The bill is a great step in the right direction, showing all the things India has to gain from online regulation,” the authors at the TribuneIndia write. Generally speaking, this is very true as blanket bans on online gaming not only don’t work, but have a rather negative effect. Thus, it is only the details, important as they are, that need to be smoothed out.

“In an unregulated, banned market, irresponsible actors and criminals are given better opportunities to take advantage of their victims,” the writers explain. “Contrary to what conservative politicians might think, banning online gambling won’t eradicate online gambling. It will only move the activity out of sight.”

According to a recent ruling by the Supreme Court, recommendations issued by the GST Council are not mandatory to the Central or State Governments. Both the proposed blanket GST levy on gaming and the blanket Online Gaming Regulation Bill will need the sanction of the Indian parliament and may undergo amendments in the process of adoption.

Hopefully, the wisdom of the country’s apex institutions will find the way to implement the necessary legislative changes in a sensible manner, moving away from the blanket approach in favor of legal and taxation frameworks with due case-by-case differentiation between the various gaming genres of the modern day.