Casino ETF Up on Las Vegas Sands' Upbeat Q3 Earnings

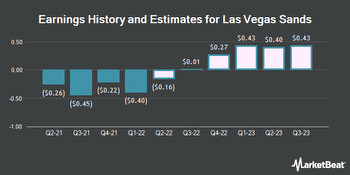

Leading international developer of multi-use integrated resorts and casinos Las Vegas Sands Corp. ( - Free Report) reported third-quarter 2023 results, with earnings and revenues beating the Zacks Consensus Estimate. The top and the bottom line increased on a year-over-year basis. The stock was up 2.9% on Oct 19, reflecting the upbeat earnings result.

During third-quarter 2023, LVS reported adjusted earnings per share (EPS) of 55 cents, beating the Zacks Consensus Estimate of 53 cents by 3.8%. In the year-ago quarter, it incurred an adjusted loss of 27 cents per share. Interest expenses (net of amounts capitalized) amounted to $200 million compared with $183 million in the prior-year quarter.

Quarterly revenues of $2.8 billion surpassed the consensus mark of $2.69 billion by 4%. The figure increased 177.2% from $1.01 billion reported in the year-ago quarter. The company notably benefited from the recovery in travel and tourism spending in both Macao and Singapore. In Macao, the company witnessed improvement in both gaming and non-gaming segments.

Furthermore, Singapore’s Marina Bay Sands portrayed performance growth. Its new suite product and elevated service offerings position the company well to deliver growth as airlift capacity continues to improve accompanied by travel and tourism spending recovery.

Balance Sheet

As of Sep 30, 2023, unrestricted cash balances amounted to $5.57 billion compared with $5.77 billion in the previous quarter. Total debt outstanding (excluding finance leases and financed purchases) was $14.17 billion, down from $14.7 billion in the earlier quarter.

In the reported quarter, capital expenditures totaled $330 million, thanks to construction, development and maintenance activities of $44 million in Macao, $141 million at Marina Bay Sands and $145 million in corporate, development and other.

ETFs in Focus

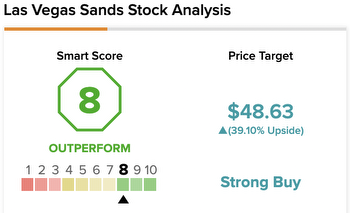

The stock has a Zacks Rank #3 (Hold) and the best VGM (Value-Growth-Momentum) score of A. The stock has exposure to VanEck Gaming ETF ( - Free Report) .

BJK in Focus

The underlying MVIS Global Gaming Index tracks the overall performance of companies involved in casinos and casino hotels, sports betting, lottery services, gaming services, gaming technology and gaming equipment. The stock LVS has about 6.52% exposure to the fund. The fund, which charges 65 bps in fees, added 0.5% on Oct 19.