View: Policy needs to demarcate the difference between gambling and gaming

The income-tax treatment of these two types of activity also differs. Winnings from games of chance are taxed at the highest slab without allowance for deductions against expenses, while games involving skill are taxed at the rate applicable to a person's income. The current GST rate of 18% on platform fees does not conflict with either the legal standing of particular games or the tax treatment of the winner's good fortune.

The issue with taxing casinos, horse racing and online gaming, which the Goods and Services Tax (GST) Council has tasked a group of state ministers (GoM) with, is the treatment of actionable claims that creditors have on debtors. The GST legislation permits taxing such claims only if these involve 'lottery, betting and gambling'. To tax the winnings as well as the platform fee, all services rendered by these entities would need to be lumped into a subhead of games of chance. This is where the tax intent runs into a legal knot.

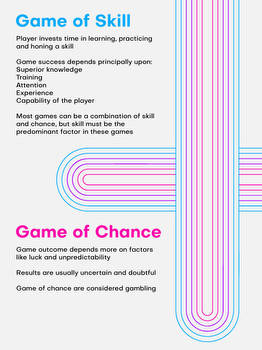

Not all services provided by casinos, turf clubs and online gaming companies can be categorised as gambling. Several states regard horse racing as a game of skill, and a clutch of high courts have struck down blanket bans on online gaming on the grounds that these do not differentiate between games of skill and chance. Casinos, on their part, provide services like food and beverages, and also offer both games of skill and chance as defined by law.

The income-tax treatment of these two types of activity also differs. Winnings from games of chance are taxed at the highest slab without allowance for deductions against expenses, while games involving skill are taxed at the rate applicable to a person's income. The current GST rate of 18% on platform fees does not conflict with either the legal standing of particular games or the tax treatment of the winner's good fortune.

The income-tax rates are a graded response designed to discourage gambling and can offer a template for taxing the services provided by gaming institutions. This involves segregating games of skill from those involving merely chance and taxing the latter as a demerit service. However, that is easier said than done. The Supreme Court has set the test for any game as the preponderance of skill involved. The Centre taxes winnings from horse racing and card games as gambling income.

The Supreme Court has upheld Section 2(52) of the Central Goods and Services Tax Act, 2017, that lottery, betting and gambling are actionable claims and come within the definition of goods. The court saw rationale in the law including only three categories of actionable claims for levying GST and found it in continuity to regulation, including taxes, that has been in force well before the new law was enacted.

The GoM would be fulfilling parliament's regulatory intent if it were to tax contest entry fees in online gaming, the value of bets in racecourses and the face value of chips bought in casinos. But this could drive these businesses under, contrary to the regulatory and revenue design of the tax.

A higher tax rate within the GST system on gross gambling revenue - as opposed to gross gaming revenue - would serve as adjunct regulation to disincentives built into the income-tax structure. An inordinate burden, such as that imposed by taxing the gross sales value, would push gambling underground or to tax-friendly jurisdictions. To that extent, taxes can be as blunt a tool as outright bans. The regulatory gains of knowing your playing customer could dissipate.

And there would be collateral damage. A higher GST rate of 28% merely on platform fees for all forms of gaming would discriminate against those involving skill. Online gaming is a new frontier in the digital economy that has spawned Indian unicorns and is driving user engagement. Tech giants like Microsoft and Facebook are placing big bets on online gaming to propel the next phase of their growth and take on established players like Tencent and Sony.

Financial regulation of gaming is a default option, because taxmen and monetary authorities approach it through the prism of tax evasion and money laundering. GoI has introduced a Bill to set up a dedicated regulator that can encourage opportunities and discourage abuse. A gaming authority could sift through the preponderance of skill that courts require for games not to be classified as regulated gambling. This would be a more holistic approach than having individual state classifications.

The Online Gaming (Regulation) Bill, 2022, proposes a regulatory regime for both games of skill and chance, and is designed to plug the legal void courts have pointed out. It, however, draws upon states' constitutional privilege of regulating gambling. If the Centre can convince the states of the need for parliamentary protection for almost half a billion Indians who play games online, it would be a considerable regulatory achievement. But the approach in the Bill, as in the approach to taxation, does not adequately differentiate between gaming and gambling.

(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com.)

Experience Your Economic Times Newspaper, The Digital Way!

- Front Page

- Pure Politics

- Disruption: Startups & Tech