Upcoming changes in Singapore’s gambling laws

I. Rationale behind legislative enhancements to Singapore’s gambling laws

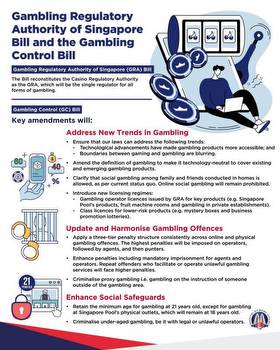

Currently, the statutes which cover all aspects of gambling in Singapore are the Betting Act 1960 (the BA), the Common Gaming Houses Act 1961 (the CGHA), the Private Lotteries Act 2011 (the PLA), the Casino Control Act 2006 (the CCA) and the Remote Gambling Act 2014 (the RGA). However, advancements in technology have made gambling products more accessible while emerging business models have blurred the distinction between gambling and gaming. To stay ahead in face of the evolving gambling landscape, the Gambling Regulatory Authority of Singapore Bill (the GRA Bill) and the Gambling Control Bill (the GC Bill) were introduced for their first reading in Parliament on 14 February 2022.

II. Establishing a single regulator for gambling

Presently, gambling regulation is overseen by the following government agencies:

- the Casino Regulatory Authority which regulates the casinos;

- the Gambling Regulatory Unit which regulates online gambling services and fruit machines;

- the Singapore Totalisator Board which governs physical gambling services operated by Singapore Pools; and

- the Singapore Police Force which takes enforcement action against unlawful gambling.

With the GRA Bill, the Gambling Regulatory Authority (the GRA) will be established as the sole regulator for all forms of gambling activities in mid-2022. The consolidation of the aforementioned government agencies into a single regulator allows for a more holistic and coherent approach towards gambling polices and issues, for the purposes of staying ahead of technological and global trends, and responding more adequately to emerging gambling products. The GRA is expected to be established by mid-2022.

III. Overview of legislative updates on Singapore’s gambling laws

The GC Bill will cover all unlawful gambling offences and the regulation of non-casino gambling. The existing statutes which deal with these, namely the BA, CGHA, PLA and RGA, will be correspondingly repealed.

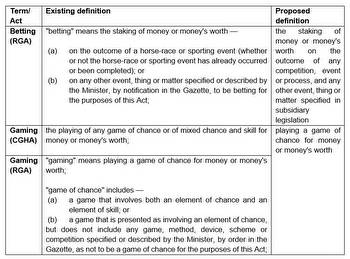

A. Technology-neutral definition of gambling

The GC Bill amends the definition of gambling to render such definition technology-neutral and capable of bringing existing and emerging gambling products under its scope. This provides the GC Bill with the flexibility to address the trend of increasing access to gambling products with technology and the emergence of business models with gambling elements. Products which the Ministry of Home Affairs (the MHA) has no intention of treating as gambling products will be carved out from the definition as they may already be subject to other regulatory frameworks. For example, investment in financial products which are already regulated by the Monetary Authority of Singapore through other legislation will be excluded from the definition of gambling.

B. Exemption regime for social gambling

Social gambling among family and friends, while not prohibited by current legislation, is however not clearly defined. Social gambling will hence be expressly defined in the GC Bill under an exemption regime for it to be lawfully conducted in homes among family and friends. However, the exemption will not apply to online social gambling, due to the difficulty in determining if the individuals partaking in online gambling activities are meaningfully and adequately acquainted with each other in the online context to constitute social gambling.

C. Licensing and class licensing regime

Licensing regimes for key gambling products will be implemented by the GC Bill. Pursuant to the GC Bill, the GRA will be able to grant licences to gambling operators for specified kinds of gambling, gaming machines, gambling articles, betting operations or conduct of gaming or lotteries. For example, the GRA will be able to issue gambling operator licences for products like fruit machines, Singapore Pools’ products and gambling at private establishments. The GRA can therefore effectively hold gambling operators accountable for their conduct of gambling and screen them to ensure that they are suitable to offer gambling products.

Class licensing will also be implemented by the GC Bill for lower-risk gambling products. A class licence authorises a person to provide a gambling service, or a class or description of gambling service, without a licence for a specified period and subject to conditions. Operators offering such lower-risk gambling products do not need to be individually licensed. For example, it is intended that a class licence be imposed for mystery boxes sold by retailers subject to the condition of the prizes having a maximum value of S$100. More information on the conditions for various class-licensed activities will be available with the enactment of the relevant subsidiary legislation in the future.

D. Rationalisation of offences and penalties for all unlawful gambling

The GC Bill provides a consistent three-tier penalty structure for all unlawful gambling activities, be it online or physical, under the existing BA, CGHA, PLA and RGA. Under the tiered penalty structure, the highest penalties will be imposed on operators, followed by agents and then punters. This is in accordance with their varying levels of culpabilities, with the operators having the highest culpability. Operators can be jailed up to seven (7) years and fined up to $500,000, agents can be jailed up to five (5) years and fined up to $200,000 while punters can be jailed up to six (6) months and/or fined up to $10,000.

It is also worth noting that the penalties for unlawful gambling will be enhanced as the GC Bill imposes mandatory imprisonment for agents and operators of all unlawful gambling activities (mirroring the position in the BA and CGHA). This is in contrast to the existing PLA and RGA where there is no mandatory imprisonment for the activities they prohibit. Repeat offenders will also face higher penalties.

E. New offence of proxy gambling

Proxy gambling occurs when an individual within the gambling area acts on the instruction of a decision-maker outside the area. Proxy gambling by such a decision-maker in casinos and fruit machine rooms will be an offence under the GC Bill. The rationale for the prohibition against proxy gambling is to prevent the decision-maker from bypassing the entry checks required for screening out individuals of concern. The decision-maker may be fined up to S$10,000 and/or jailed up 12 months.

F. Enhanced social safeguards for underage and excluded persons

Presently, there is no one minimum age which applies to all gambling activities and the minimum age to gamble legally will vary according to the venue of the gambling activity. For instance, Singapore Pools only allows individuals aged 18 and above to purchase 4D and TOTO tickets or place horse racing bets. Under the CCA, one must be aged 21 and above to gamble in casinos.

Underage gambling will be criminalised under the GC Bill. One must be at least 21 years old to gamble legally, except for gambling at Singapore Pools’ physical outlets where the minimum age remains at 18 years old. It will be a criminal offence for underage individuals to gamble, even if the operators are operating lawfully. It will also be a criminal offence for underage individuals to enter gambling areas which require entry checks.

Under the existing CCA, an exclusion order can be given to a person to prohibit him or her from entering or remaining on the casino premises. The GC Bill expands the harm minimisation measures that may be ordered by the National Council on Problem Gambling (the NCPG) to cover general remote gambling and gambling in gaming machine rooms outside of the casino. It will be an offence for such excluded persons to gamble and enter gambling areas across all platforms and locations where the NCPG exclusions are applicable, such as fruit machine rooms and Singapore Pools’ online gambling. Nonetheless, a contravention of such exclusion orders by persons under self-exclusion will not be an offence under the GC Bill. This seeks to avoid deterring individuals from applying for self-exclusion to restrain themselves from entering casinos.

Operators that gamble with underage or excluded individuals, or allow them to enter gambling areas will be liable for an offence or disciplinary action by the GRA.

G. Offences related to advertising and promotion of gambling activities

Currently, the threshold for proving an offence relating to the advertising and promotion of gambling activities is lower than that for online gambling under the RGA as compared to unlawful physical gambling under the BA and CGHA. The GC Bill will introduce a consistent treatment of such advertising and promotion offences across all gambling modalities. It will make it easier to disclose offences related to the advertising and promotion of illegal physical gambling by removing the need to link them to the involvement of actual gambling, as in the case for the advertising of illegal online gambling.

IV. Concluding thoughts

The draft legislation introduced by the GRA Bill and the GC Bill is wide-ranging and will have significant implications on all gambling operators. Minister for Social and Family Development Masagos Zulkifli said in a statement that his ministry “strongly support[s] the legislative enhancements made by MHA, which will further minimise the harm of gambling to vulnerable groups, such as minors.” Operators of land-based casinos and operators of online games with gambling elements will need to carefully monitor the passing of the GRA Bill and the GC Bill and consider the effects it will have on their operations, and possibly make adjustments to ensure that their operations abide by the conditions and safeguards that will be imposed.

*Dentons Rodyk thanks and acknowledges Legal Executive Sean Gallagher and Practice Trainee Tan Wei En for their contributions to this article.