Two casino properties receive licensing approval from Nevada Gaming Commission

The Nevada Gaming Commission on Thursday unanimously approved licenses for a newly renamed Henderson casino and fast-growing Bally’s Corp., and approved Caesars Entertainment Inc.’s multibillion-dollar deal to acquire Nevada’s largest sportsbook operator.

The Pass at Water Street, formerly known as the Eldorado Casino in Henderson, won licensing approval and will reopen April 1 after being closed for more than a year.

Commissioners also approved a series of licenses that register Bally’s as a publicly traded company in the state, operate the Montbleu resort in Stateline at Lake Tahoe and issue favorable suitability findings for several of its executives.

They also green-lighted Caesars’ $3.7 billion deal for William Hill U.S., first announced in April and approved by shareholders of both companies. The deal is scheduled to close Tuesday.

The Pass at Water Street

Joe DeSimone, sole owner of the The Pass at Water Street and a longtime Henderson developer, acquired the Eldorado Casino for an undisclosed price from Boyd Gaming Corp. in December.

The property will have more than 350 slot machines. Circa Sports will manage the casino’s sportsbook. A license for Circa at The Pass is expected to be heard by regulators in future weeks.

Twenty-four-hour dining will be offered at Emilia’s Cafe, named for DeSimone’s daughter, while Ristorante Italiano will offer fine dining options Thursday through Sunday evenings. The property will also have two bars: the Pass Bar and Silver Bar.

The reopening will bring about nearly 100 new jobs, with many former employees from Eldorado returning.

DeSimone Gaming also owns the Railroad Pass Hotel and Casino in Henderson, near Boulder City. A shuttle will run between the two casinos seven days a week, and customers at both properties will have access to a linked players’ club.

Bally’s Montbleu deal

Bally’s — a Providence, Rhode Island-based regional gaming company that has no affiliation with the Strip casino with the same name — acquired Montbleu in a two-property package deal for $155 million as part of Eldorado Resorts’ bid to divest properties in advance of its acquisition of Caesars Entertainment Inc. Bally’s was an alternate buyer after Eldorado had originally announced it was selling to privately held Maverick Gaming.

The Montbleu deal is expected to close in early April.

Bally’s views Montbleu as a destination resort for customers from its other operations nationwide.

The company has had another connection with Caesars — it acquired the Bally’s brand from that company in November.

Bally’s owns and operates gaming and racing facilities across the United States. Its gaming and racing facilities include slot machines and various casino table games, and restaurant and hotel facilities. As of December, it owned and operated 11 casinos that comprise 13,260 slot machines, 459 game tables, and 2,941 hotel rooms, as well as a horse racetrack across seven states.

Bally’s President and CEO George Papanier told commissioners his company has one of the best regional gaming footprints in the market and the third-largest footprint for online sports betting in the United States.

Bally’s also plans to leverage its recently announced partnership with Sinclair Broadcast Group Inc.

Sinclair, which operates 21 sports networks and 188 television stations across the United States, including KSNV Channel 3, Las Vegas’ NBC affiliate, plans to incorporate Bally’s branding to its regional sports networks.

Caesars-William Hill

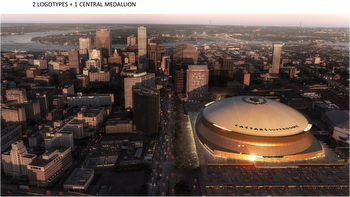

Commissioners also approved Caesars’ acquisition of William Hill, which has more than 120 sportsbook and kiosk locations across Nevada and is a subsidiary of United Kingdom-based William Hill Plc.

Caesars has held a 20 percent equity ownership in William Hill. Caesars CEO Tom Reeg said the transaction changed course from a partnership to Caesars making William Hill the core of its sports wagering system.

“We wanted to sit at the steering wheel ourselves,” Reeg said. “We’re essentially going from a 20 percent to a 100 percent position.”

Through the joint venture, William Hill runs online sports betting operations through Caesars’ market access in each state and retail sports betting operations in Caesars’ properties as well as those of other casino operators around the United States. Caesars owns and operates 54 domestic properties in 16 states. The company’s resorts operate primarily under the Caesars, Harrah’s, Horseshoe and Eldorado brand names.

Caesars, strictly a domestically operating company, plans to sell any William Hill operations with ties outside of the United States.

Reeg said the company has received some pushback from casinos not affiliated with Caesars worried about that company coming into their buildings, but Reeg pledged not to use Caesars branding at William Hill sportsbooks in non-Caesars properties.

Reeg, who has seen big mergers before — he led Reno-based Eldorado Resorts Inc.’s effort to acquire Caesars for $17.3 billion in 2019 and 2020 — said he expects sportsbooks to help drive traffic to other parts of the casino.

“We’ve seen customers show up that were not otherwise coming that skews younger, tends to be a table-games customer, tends to drink a lot of beer — all good for a casino operator,” Reeg told the Gaming Control Board earlier this month.

William Hill, the third-largest sportsbook operator in the United States, has ridden a wave of expansion that began in 2018 when the U.S. Supreme Court overturned the Professional and Amateur Sports Protection Act, leading the way to legal sportsbooks in states that wanted them.

rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.