The best bets in the gambling sector: an industry that will grow and grow

The desire to bet “has been part of human nature [since] time immemorial”, says Russ Mould of AJ Bell. However, as many people have found out the hard way, one of the iron rules of betting is that while individual punters can do well, for the majority the long-term outcome is that the “house always wins”. This is why the global gambling industry is worth $475bn and will reach $550bn by 2023, estimates Professor Leighton Vaughan Williams, director of the betting research unit and professor of economics and finance at Nottingham Business School.

The internet has supercharged the sector

One part of the industry expanding at a rapid pace is online gambling. Part of this is due to lockdowns, which have “increased engagement by existing online players” stuck at home, says Williams. However, he expects this part of the market to keep growing at breakneck speed even after restrictions are removed and things return to normal. While it still only accounts for $60bn in sales, around 15% of the overall sector, this figure should rise by 50% to $90bn over the next two years.

Lockdown restrictions aren’t the only factor driving online growth, says Maksym Liashko of online betting firm Parimatch. He thinks that the convenience of smartphone betting has also caused the amount of money wagered online to grow, as it makes it much easier to bet at short notice, or even while the event itself is taking place. This is particularly important as a sporting spectacle such as a football match only lasts a relatively short amount of time.

While the binary nature of sporting contests, with a winner and a loser, means that “sports and betting have always gone together”, the rise of high-profile international sporting events viewed by huge numbers of people has further fuelled the online boom. One example of this is football, with the Champions League and the Premiership followed by hundreds of millions of people across the globe. It is therefore no surprise that football teams have been major recipients of advertising from gambling companies, with ten out of 20 Premier League teams having some form of gambling advertising on their shirts, either on the front or on the sleeves.

Liashko thinks that the final element of the online gambling boom has been the large increase in marketing expenditure by gambling companies in recent years. Part of this has involved firms building up their brands in order to stand out from rivals in an intensely competitive environment. But it has also made people more aware of the opportunities available, helping grow the size of the overall market. He is confident that thanks to all these factors the rapid pace of growth in online betting will endure for the foreseeable future.

Cracking America

Perhaps the most compelling opportunity for the online gambling industry is the US. In 1992 President George H. W. Bush signed the Professional and Amateur Sports Protection Act (PASPA), which effectively banned sports betting throughout the US (with the exception of Las Vegas). Fourteen years later his son George W. Bush would tighten the law further by signing the controversial Unlawful Internet Gambling Enforcement Act (UIGEA) of 2006. It did not target internet gambling per se, just illegal online gaming: it stopped US companies (including banks) accepting money produced by unauthorised gambling sites. However, since all online sites fell into that category, UIGEA effectively prevented offshore bookies accepting money from Americans.

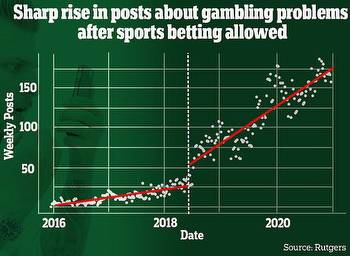

Although there have been several attempts to repeal the bill it is still in force. The good news for the industry is that a 2018 lawsuit from New Jersey overturned the federal ban on sports betting (PAPSA)on constitutional grounds. This allowed it to find a way to escape the impact of the UIGEA, which provides exemptions by deferring to state law. In essence, if a state says a gambling outlet is legal, the UIGEA does not apply. So from 2018 states could say sports betting – online too – was legal.

Legalising sports betting

The legalisation of sports betting provides a “huge opportunity” for the industry, says AJ Bell’s Mould. Even though the Supreme Court’s decision striking down PASPA is less than three years old there has already been a rush towards legalisation. Indeed, “over 20 states have already legalised bets, with most of them allowing online gambling in some form”.

What’s more, “five more have legislation already pending and more than a dozen others could launch new laws for approval in 2021 and 2022”. While California “is not expected to permit wagering until 2023 or beyond”, Mould is confident that “the direction of travel is clear” unless “a major sporting scandal” prompts a “major rethink”.

Of course, removing all restrictions doesn’t mean that there’s going to be a free-for-all with any operator allowed to pitch up. Indeed, Robin Wood, chief financial officer and deputy CEO of FTSE 100 gambling group Entain, admits that virtually all states that have legalised online gambling so far – whether sports betting or another kind – have erected large barriers to entry. The most notable of these is the requirement to have either an existing physical presence in the state, in the form of a licence to run a casino, or at least have a joint venture with such an operation, as Entain currently has with MGM.

Legal restrictions aside, any company attempting to crack the American market will also have to spend a lot of money to reach the “critical mass” that will allow it to take advantage of economies of scale. As a result, while there may be “a lot of niche operators” taking an interest at present, Wood thinks that within five to ten years many of those will have decided to drop out, while mergers will further reduce the numbers.

As a result, the market will end up “very consolidated”. In addition to the casino chains, the companies that have been running “fantasy sports” (competitions where people win cash prizes for selecting the players who will do best over the course of a season) currently have a head start, although he thinks that it will not be insurmountable.

Still, although the US market may prove a huge challenge, the rewards for those companies that manage to find their feet in it will be immense. Indeed, he predicts “decades of growth”, with states such as Texas, Florida, and eventually even California, opening up their markets. With the US already generating “almost as much money for Entain as the rest of the world put together”, he reckons total online gambling revenue in the US could reach $20bn by 2025, a forecast shared by many of his competitors, such as Flutter.

Gambling goes global

Of course, the US isn’t the only market that is rapidly expanding. While Liashko thinks that it isn’t worth firms such as Parimatch trying to challenge the major American players, smaller companies can still grab a piece of the action in the rest of the world. Indeed, many places are deciding that the increasing popularity of offshore gambling companies means that they may have no choice but to legalise the activity formally, as many are now doing, most notably Germany, which is in the process of bringing in a law.

Even fully legal gambling in China is “only a matter of time”, says Liashko. The rise of the middle class in emerging markets, as a result of decades of strong economic growth, is already starting to provide a boost to the industry’s bottom line and shift the balance of power eastwards. For example, Professor Vaughan Williams notes that the Asia-Pacific region is “already a fast-growing market for gambling in the world”, and this is “expected to continue”.

Overall, Entain’s Rob Wood argues that policymakers across the world are now realising that bans can be counterproductive, while liberalisation can allow countries to get ahead of rogue firms and create a framework in which “consumers are protected, tax revenue is generated and more money can remain in the local economy”.

Allowing legal online gambling can also help undermine the huge number of black-market bookmakers, a problem in all countries, including the US, as “all the evidence shows that consumers will switch to proper operators once gambling is legalised”.

Perhaps the only significant fly in the ointment is the UK, one of the earliest markets to liberalise. There has been increasing pressure to tighten up regulation. Last year the Gambling Commission brought in rules to make online casino games “less harmful”, including increasing the amount of time between slot-machine game cycles and removing “displays of net financial position and elapsed time during gaming sessions”, says Richard Williams, gambling and regulatory partner at Keystone Law. It is working on another review, which may recommend new rules such as “more restrictions on gambling advertising” and even “possible mandatory deposit or loss limits”.

Still, it’s important not to overstate the impact of such rules, says Williams. Any further restrictions “are likely to focus mainly on casino (particularly slot-machine) games”, with “less risky” forms of gambling such as sports betting or lotteries less heavily affected. Indeed, rules governing some forms of gambling may be relaxed: “the restrictions imposed on physical casinos are seen as unfair when similar restrictions do not apply online”.

To read the whole of this article,