PLAYSTUDIOS Announces Licensing Deal with IGT for New Casino Content Integration

On May 4, 2023, PLAYSTUDIOS, Inc. made an exciting announcement regarding its licensing deal with IGT, a top provider of casino content worldwide. For the first time, PLAYSTUDIOS will be able to incorporate popular IGT content into its chance-based casual games. The first three titles set for release are “Wolf Run™ Eclipse,” “Money Mania Pharaoh’s Fortune™,” and “Wheel of Fortune® Cash Link Australian Outback.” These new games will be available on PLAYSTUDIOS’ myVEGAS Slots platform later this year.

PLAYSTUDIOS is renowned for its playAWARDS loyalty platform and award-winning free-to-play mobile games that offer real-world rewards to players. Among its suite of chance-based mobile apps are the popular myVEGAS Slots and POP! Slots. With the licensing deal with IGT, PLAYSTUDIOS can now introduce IGT’s proven content and game models to its casual, free-to-play audience. Katie Bolich, Co-Founder and Head of Product at PLAYSTUDIOS, expressed her excitement, stating that “to have the opportunity to work with IGT and bring their proven content and game models to our casual, free-to-play audience is a win-win.”

NET Stock: Strong Earnings and Revenue Growth in the Technology Services Sector

On May 4, 2023, NET stock opened at $41.85, slightly lower than the previous close of $41.90. Throughout the day, the store experienced a day’s range of $40.99 – $42.83. The trading volume for the day was 2,399,966, which is significantly lower than the average volume of 5,206,915 over the past three months. The market cap for NET stands at $15.6B.

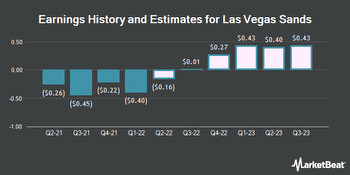

NET has shown impressive earnings growth over the past year, with a growth rate of 28.90%. The company’s earnings growth for the current year is even more unique, at 145.90%. Over the next five years, NET is expected to continue its growth trend, with a projected earnings growth rate of 20.00%. The company’s revenue growth rate for the last year was 48.57%.

NET’s P/E ratio is unavailable, likely due to the company’s negative earnings per share (EPS) in the previous year. The company’s price/sales ratio is 15.13, and its price/book ratio is 24.81.

NET’s next reporting date is August 3, 2023, and the EPS forecast for the current quarter is $0.07. The company’s annual revenue for the last year was $975.2M, with a yearly loss of -$193.4M. NET’s net profit margin stands at -19.83%.

NET operates in the technology services sector, specifically the information technology services industry. Overall, NET has shown strong growth in earnings and revenue over the past year, and is projected to continue this trend.

Cloudflare Incs Stock Predicted to Increase by 33.95%: Investment Analysts Suggest Holding Stock with Concerns About Future Expansion

On May 4, 2023, Cloudflare Inc’s stock had a median target of $55.00, with a high estimate of $82.00 and a low estimate of $38.00, representing a +33.95% increase from the last price of $41.06. The current consensus among 30 polled investment analysts was to hold stock in Cloudflare Inc, with concerns about its ability to continue expanding at the same rate. Cloudflare Inc reported earnings per share of $0.07 and sales of $305.6M, which did not significantly impact the stock’s performance. The company’s next reporting date was set for August 3, which could potentially significantly impact the stock’s performance.