New GST implications on online gaming industry- India

The Directorate General of GST Intelligence has issued a show-cause notice to the Karnataka based online gaming company, Gameskraft Technologies Private Limited. The company did not deposit the required amount of tax between 2017 and 2022. A panel of Ministers has been constituted to examine and formulate a revised GST tax structure for the online games industry.

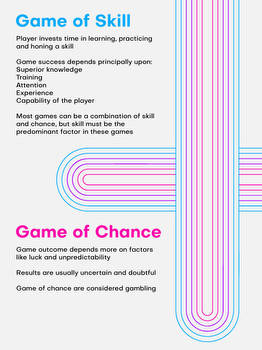

The current GST regime differentiates between online games based on skills and chance. The line between the two is thin. A 28% GST is chargeable under the HSN 999692 on the total bet value. Gameskraft Technologies is one of the companies that has been affected by the new tax regime.

GST rate of 28% to be made applicable on all online games, including games of skills and chance. The rate will be chargeable on the total stake value and not on platform fee paid by the user.

A flat GST rate of 28% to be made applicable on all online games, including games of skills and chance. The rate will be chargeable on the total stake value and not on platform fee paid by the user.

The increase in GST tax rate from 18% to 28% is likely to impact the operations of online gaming companies. The cost per game for players will also increase by three to four times.

New GST implications on online gaming industry- India.