New casino tax regime for Singapore

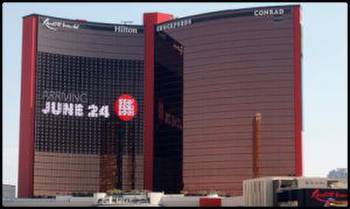

Lawmakers in Singapore have amended the Casino Control Act to introduce a new tiered tax system for the island nation's two integrated casino resorts. The new provisions were first proposed in 2019 as part of a scheme that saw the Marina Bay Sands and Resorts World Sentosa developments being allowed to expand their local gambling operations.

The current 15% flat tax rate on all mass-market gross gaming revenues is set to rise to 18%. The two casinos will also be obliged to pay a 22% duty on any amount beyond $2.3 billion. The VIP receipt category covers all earnings derived from punters who have deposited over $74,000.

In return for agreeing to pay higher rates of tax, Singapore will let Las Vegas Sands Corporation and Genting Malaysia Berhad keep their current duopoly over the lucrative casino market until the end of 2030.

The two casino operators agreed to a 50% bump in the entry fees they are obliged to charge local punters. The cost of a 24-hour pass went up from around $74 to about $110. An annual permit went from slightly over $1,479 to approximately $2,219.

The Las Vegas Sands Corporation is sceptical about the completion of the expansion to its Marina Bay Sands development in Singapore by the 2025 deadline. The project involves working with government agencies to get their approval.