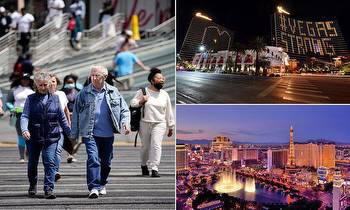

Nevada Hits $1 Billion In Gambling Revenue For 12th Consecutive Month

Nevada recorded $1.1 billion in gaming revenue in February, marking the 12 consecutive month the state brought in .

February also set an all-time win total for the month, $1.07 billion in 2013 was the previous record, and revenues from The Las Vegas Strip hit its third-highest level in history. According to the Nevada Gaming Control Board, state gaming revenue in February was up 10% over pre-pandemic levels in February 2019.

“It’s a good day for Nevada—the streak continues,” says Brendan Bussmann, the managing partner of B Global, a consulting firm focused on gaming, sports and hospitality. “The way I look at this, with a year under our belts, the bar for a new floor has been set: a billion bucks a month. We’re not bumping up against the ceiling.”

After the early days of the pandemic dealt a crushing blow to Nevada’s casinos—annual gross gaming revenues plummeted from $12 billion in 2019 to $7.8 billion in 2020—the Silver State’s most important industry has roared back to life. The state started its $1 billion in gaming revenue per month in March 2021, just as Covid capacity restrictions in casinos started to ease and Nevada reported a record $13.4 billion in annual gaming revenue in 2021.

Michael Lawton, a senior research analyst for the Nevada Gaming Control Board, says the entertainment and sports calendar helped bolster February’s revenues. Vegas hosted both the NHL All-Star Game and the NFL Pro Bowl last month. The Super Bowl, the largest single-game betting event of the year, and the lack of mask mandates also helped. Musicians like Garth Brooks, Justin Bieber, Billy Joel and Metallica also helped bring in crowds.

“I’m not super surprised by this month’s results,” says Lawton. “Once I saw the event calendar, I would’ve been shocked if we didn’t hit $1 billion.”

February is usually a big month for baccarat, especially during Chinese New Year. But with international travel still below pre-pandemic levels, baccarat win percentage of total gaming revenues on The Strip only hit 10.37% in February, down from 29.2% in February 2018. Instead, slot machines continued to carry their weight. The classic casino cash cow brought in nearly 70% of the state’s total gambling revenues in February, which is above the 10-year average of 63.3% of state revenues coming from slots. “Slot win is on this torrid pace,” says Lawton.

According to the Las Vegas Convention and Visitors Authority, visitor volume to Vegas was up 70% in February compared with last year, but still down 18% compared with 2019. Hotel occupancy is also down nearly 18% from 2019 and convention attendance is down 41% from 2019.

After a year of $1 billion in monthly gaming revenues, the state’s casinos have bounced back from the depths of the pandemic-induced recession. Colin Mansfield, an analyst who covers gaming and leisure at Fitch Ratings, says no one is waiting for Las Vegas to recover. “If you’re talking about revenue, Vegas is back,” says Mansfield. “But when it comes to conventions, Vegas should be fully recovered by the latter half of 2022.”

Thanks to inflation, a pullback from the leisure market is expected, but Mansfield says that business and international travel to Vegas is expected to pick up the slack. Gas prices are also a concern, but historically rising gas prices have not had a material impact on Vegas visitation.

Bussmann says the domestic market has recovered, but there’s still room to go up once the international customer and the business traveler returns to Sin City. He says the forces that drove the recovery have run their course and he expects to see $1 billion in revenue for Nevada month after month. “We’re past pent-up demand, we’re past the stimulus checks,” says Bussmann. “This is all about people wanting to get away and enjoy an acceptable form of entertainment.”

When asked if the $1 billion per month streak is the new normal, Lawton wouldn’t say. Inflation, war, rising gas prices, a new variant, are all factors that he believes should be taken as threats to the recovery. “I’m not going to jinx it,” he says. “There are a lot of macro-economic things going on; concerning headwinds that we’re facing. I would love for $1 billion to be the new norm, but I'm not ready to say it. They might have been saying the same thing in 2007. What's always in the back of my mind is: when will the other shoe drop?”