Defense World

Bank of Nova Scotia Sells 7,598 Shares of Las Vegas Sands Corp. (NYSE:LVS)

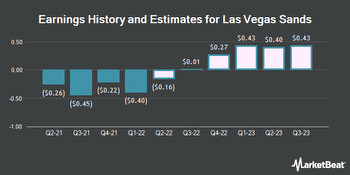

Bank of Nova Scotia reduced its position in Las Vegas Sands Corp. (NYSE:LVS

-

Get Rating) by 11.6% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 58009 shares of the casino operator's stock after selling 7598 shares during the quarter. Bank of Nova…