Macau casino gambling revenue down ‘only’ 72.5% in October

Macau casino gambling revenue fell ‘only’ around three-quarters in October, which apparently qualifies as a roaring success in this pandemic-plagued year.

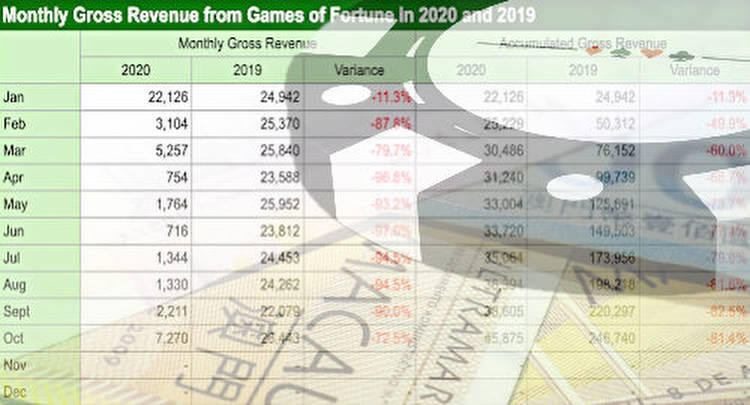

Figures released Sunday by Macau’s Gaming Inspection and Coordination Bureau (DICJ) show market-wide casino gaming revenue of MOP7.3b (US$914m), a 72.5% decline from the same month last year but the highest monthly total since the MOP22.1b reported in (mostly) pre-pandemic January.

The 72.5% decline was also the smallest in percentage terms since January and October’s financial sum represented a significant rise from September’s MOP2.2b. However, October did include the annual Golden Week holiday celebration, so perhaps everybody might want to opt for chugging their cheaper champagne for the time being.

For the year to date, gaming revenue sits just under MOP45.9m, an 81.4% decline from the sum reported over the first 10 months of 2019. But with gambling tax revenue accounting for 80% of the special administrative region of China’s budget, this unprecedented shortfall is having serious ramifications not just for casino operators but for Macau residents as a whole.

Macau’s government recently forecast that its 2021 revenue would be MOP1b higher than expenditure, but that’s after tapping into a MOP26b extraordinary reserve, leaving the administration vulnerable in case of other emergencies, such as a typhoon.

China has been slowly adding regions that qualify for the issuance of new travel visas and Macau’s government expressed hope that Beijing would provide “strong support for Macau’s economic development.” But consumer uptake of the travel visas has been slower than desired, in part due to ongoing testing and quarantine rules.

Macau’s decline has been broad-based, with both VIP and mass market gaming reporting Q3 activity that represented a shadow of their former selves. China’s increasingly strident campaign against ‘cross-border’ gambling, with its emphasis on deterring unauthorized capital outflow, poses a particular problem for VIP gambling resuming its former glories.