How New Jersey spends its iGaming tax revenue

New Jersey's gaming industry has been on the rise for the past nine years. Five casino-related taxes and five casino related fees are used to pay the state's gambling budget. The state’s gambling sector has reached an important revenue milestone in 2021.

New Jersey's income tax rate ranges from 1.4% to 10.7%. The state also has a 6.625% sales tax. Life sciences are among New Jersey’s most important businesses. New York has the largest concentration of scientists and engineers.

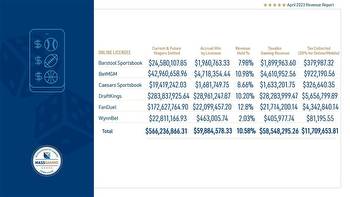

The Casino Revenue Fund receives the 8% tax on gross revenue from casinos. The 15% Internet Gross Revenue tax has been placed into the Casino revenue fund since November 2013. Casino Licensees are allowed to deduct Promotional Gaming Credits from the tax.

How New Jersey spends its iGaming tax revenue. Casino license holders are required to pay an investment alternative tax. The profits from the bonds will be used to fund community initiatives.

Gaming taxes in New Jersey are mostly used to aid the elderly. Money in the Casino Revenue Fund is used for cuts in property taxes, rentals, phone, gas, electricity, and municipal utility charges.