Here's why Ministers are recommending uniform 28% GST on online gaming, casinos, horse racing

The online gaming sector in India is one of the fastest-growing sectors in the media and entertainment space. In a bid that is expected to hit the nascent online gaming industry in the country, the ministers on Tuesday reiterated that the goods and services (GST) tax be hiked by 10 per cent to the uniform slab of 28 per cent, irrespective of whether it’s a game of skill or chance.

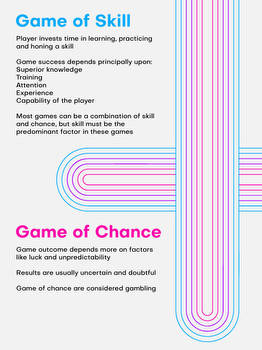

The development comes as regulatory and tax challenges continue to exist alongside the industry’s enormous development potential. Currently, the GST laws for games of skill and games of chance that resemble betting or gambling are quite different in terms of both- the tax rate and the amount that must be levied.

Game of skills VS game of chance

Since there is no definition of what counts as a game of skill or chance, the court will be determining its values and whether the tax rate is applicable. This decision is somewhat dependent on the state regulations and the game’s characteristics- whether the aspect of the game is the degree of skills and judgment in comparison to that of a chance.

Thus, the GST council has constituted a committee of the Group of Ministers (GoM) to examine the tax issues on online gaming and horse racing, and casino, while consulting with the state governments. The eight-member panel is led by Meghalaya Chief Minister Conrad Sangma, who had earlier recommended a uniform rate of 28 per cent for all games with no distinction.

Tax on the game of skills vs chance

The game of skill is usually taxed at 18 per cent GST on the platform fee also known as Gross Gaming Revenue (GGR) or the rake fee, while the game of chance is understood to be taxed at 28 per cent GST on the contest entry amount.

For the valuation of casinos, the GoM suggested that GST be applied at 28 per cent on the full face value of chips/coins that are purchased by a player from the casino. It added that once GST is levied on the purchase, no further GST would apply on the value of bets placed in each round of betting including those who played with winnings of previous rounds.

The panel suggested that GST on services by way of access or entry to casinos on entry fee payment compulsorily includes the price of one or more supplies, including food, beverages, etc.

While for gaming and horse racing, the ministers concluded that the GST of 28 per cent on the face value of the bet should be applicable.

Charging 28 per cent GST on the entire amount that a player deposits for a game for both categories of online game, would reduce the prize money left for distribution and drive away players from legitimate tax-deducting portals, reported PTI. This may also encourage online gamers towards unlawful portals that do not deduct tax, sector experts had said.