Gambling mindset grips many Indonesian investors

JAKARTA, Feb 12 (Jakarta Post/ANN): The recent popularity of binary option trading has seen many unaware Indonesians lose significant amounts of money and led to blurring of the line between investing and gambling.

Professional traders warn that similar confusion can also happen with legal financial instruments as novel money-making propositions beckon a growing number of retail investors in the country.

A binary option requires the user to make a guess on the price of an asset – be it a stock, a cryptocurrency, commodity or foreign exchange rate – and put their money on it.

The Financial Services Authority (OJK) has declared binary option trading illegal and the Commodity Futures Trading Regulatory Agency (Bappebti) has begun to crack down on the practice.

Bappebti has warned investors they could lose their money on such instruments as there is no formal resolution mechanism. In a press release from Feb. 2, Bappebti acting head Indrasari Wisnu Wardhana called binary option trading "a gambling scheme disguised as investment."

Last year, Bappebti banned 92 web domains selling binary options, including the infamous Binomo hyped up by online influencers. During the same period, the agency blocked 1,222 sites or platforms falling under the commodity futures trading category.

Verifying the legality of a product or platform could help investors avoid dangerous or fraudulent options, but that may not be enough to avoid crossing the fuzzy line into the territory of gambling.

“Legal and normal investment activities, such as in the stock market, could also amount to gambling, depending on how we do it,” Desmond Wira, a full-time trader and author of several bestselling investment books, told The Jakarta Post.

The capital market is one of the most enigmatic sectors for Indonesians.

Capital market literacy in the country stood at only 4.9 percent of the population surveyed by the OJK in 2019, whereas insight into other businesses was at least three times higher.

The OJK data also show that capital market literacy only grew by 1.1 percentage points over the last decade, whereas banking industry literacy grew by 14.32 percentage points.

Knowing the risks and how to control them was the first task for investors, Desmond said, or else any further decision would be mere speculation and gambling.

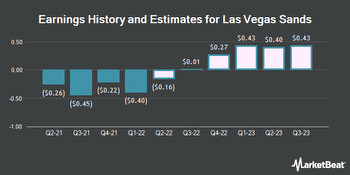

With stocks, this basic knowledge pertains to details on the company bought into, like its industry, prospects and performance. Even a seasoned trader needs to make a proper plan and watch price trends closely to avoid speculating too much.

“Buying stocks just based on feeling is actually gambling,” he said.

Using borrowed money in the hope of quick gains could also encourage gambling behavior, Desmond said, as a drop in the stock price, for instance, would compound the debt burden.

Many Indonesians experienced this first hand in early 2021, as they found themselves trapped in debt when stock prices fell.

Ariston Tjendra, a money market analyst and a forex trader, said that another example of gambling was decision-making based on the influence of friends or public figures.

“We have to be critical regarding every investment offer or chance. Be sure to always question and learn,” Ariston said.

In 2021, several public figures showed off their portfolios of Indonesian stocks, stirring up bullish sentiment and getting others to follow their trades.

Many retail investors ended up buying at high prices, only to see the market turn bearish afterward.

In late 2021 and early 2022, several online influencers gave ostentatious testimonies of their success in binary options, some putting on display wealth supposedly gained through such investments.

Aside from such questionable but legal hype, Ariston also warned of fraudulent promises of easy passive income through algorithmic trading, also referred to as trading robots.

In some cases, he said, the operations behind them were simply Ponzi schemes, in which a person’s supposed gains were simply taken out of subsequent entrants’ funds. Bappebti closed 336 of these operations in 2021.

Eko Endarto, a financial planner and founder of Financia Consulting, told the Post that sticking to an investment plan could keep investors from gambling-like decisions.

The investment timeframe should be at least one year instead of days, or even seconds. The plan would also need to be assessed periodically, as trends and sentiment could change.

Eko added that a newcomer should consider starting with a small amount rather than directly chipping in all the available funds. He noted that each person had a different risk tolerance, which needed to be developed gradually.

“Even if you decide to actually gamble on something, always start small, as you begin to learn the risks,” Eko said. - Jakarta Post/ANN