For casinos, more competition from New York may be in the cards

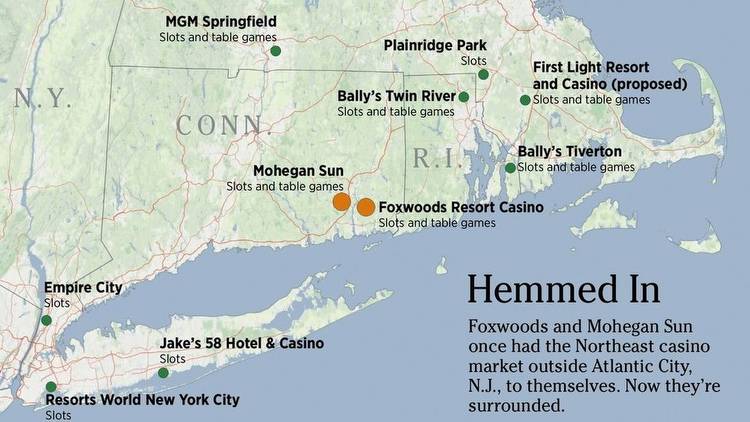

While that prospect still might seem far-fetched, the likelihood that New York state will license two full-scale casinos near the Connecticut border by the end of the year is very real.

Foxwoods Resort Casino and Mohegan Sun have been expecting it.

Ever since Empire City Casino and Resorts World New York City opened at Yonkers Raceway and Aqueduct, respectively, more than a decade ago, their slots-like video display terminals have been reaping revenues that first rivaled and then surpassed the southeastern Connecticut casinos’ slots revenues.

After all, “They are the two biggest racinos on earth,” said Clyde Barrow, an expert on Northeast gaming.

It was only a matter of time, Barrow said, before Empire City and Resorts World are licensed to operate table games in addition to VLTs. If they’re granted full casino licenses that enable them to expand their gambling options, hotels and entertainment venues likely would follow, he said.

Both Jason Guyot, Foxwoods’ president and chief operating officer, and Ray Pineault, president and CEO of Mohegan Gaming & Entertainment, Mohegan Sun’s corporate parent, said they’ve been monitoring the New York state legislature, where both houses are working on budget bills calling for the licensing of downstate casinos.

After licensing four upstate casinos in 2014, New York didn’t plan on licensing any more until 2023, but Gov. Kathy Hochul included a one-year acceleration of the process in her January budget proposal.

“Whether it’s this year or next, it’s going to happen,” Barrow said. “I think the real question is how many licenses — one, two or three. I think it might be just two, with Empire City and Resorts World New York City clearly the front-runners. They’re known quantities, they have political insiders behind them and they’re already in place.”

Barrow, a professor of political science at the University of Texas Rio Grande Valley and a principal at Pyramid Associates, a consulting firm specializing in the economics of gaming markets, has advised such gaming operators as the Oneida Indian Nation, which owns Turning Stone Resort Casino in Verona, N.Y., and MMCT Venture, the partnership the Mashantucket Pequot and Mohegan tribes formed to pursue an East Windsor casino proposal in Connecticut.

He doesn’t think the Connecticut tribes, respective owners of Foxwoods and Mohegan Sun, have a lot to worry about from full-scale casinos in Yonkers and Queens, N.Y.

“They would affect Mohegan Sun, which still draws significantly from the New York market, more than Foxwoods,” Barrow said. “They’d siphon off some gamblers, but I don’t think it would be devastating, just kind of a small incremental decline (in business) like they saw with slots. Now, they’d take a hit on table games.”

A Manhattan casino’s a long shot, in Barrow’s view, despite what he said is a gaming-industry trend toward development of megacasinos in major cities. He cited MGE’s ongoing project near Seoul, South Korea, as an example.

“If you put one in Manhattan, you’re not going to get the bang you’re looking for elsewhere, like in Yonkers and Queens,” he said. “My guess is they won’t award a third license.”

Barrow also said new data show the “average propensity to gamble” among the populations of Los Angeles, Chicago and New York is lower than it is among suburban populations, which he said is likely due to the wide variety of alternative forms of entertainment available in major cities. As a result, he said, revenue projections for big-city casinos tend to go unmet.

Further casino expansion in Massachusetts also could impact Foxwoods and to a lesser degree Mohegan Sun, though the threat is not considered imminent. The Mashpee Wampanoag Tribe’s proposed $1 billion First Light Casino project in Taunton, stalled since 2016 amid legal challenges, got a major boost in December when the U.S. Department of the Interior reaffirmed the tribe’s sovereignty and right to reservation land that includes the casino site. But things have changed.

“I don’t see how it’s viable anymore,” Barrow said of the Taunton project.

Massachusetts now has two well-established casinos in MGM Springfield and Encore Boston Harbor in Everett as well as a slots parlor in Plainville, and Bally’s Tiverton, R.I., casino near the southeastern Massachusetts-Rhode Island border also has entered the picture.

“They may want to forget it, which would be good news for Connecticut,” Barrow said of the Mashpees.

Guyot, the Foxwoods CEO, said he does expect the Mashpees to pursue their Taunton casino, though not for at least five years. He said he expects the size and scope of the project to be based on market conditions prevailing at that time.

“We’re very supportive of the Mashpees’ efforts,” Guyot said. “We wish them the best.”

He noted another casino has been proposed by the Mashpee Aquinnah Tribe on Martha’s Vineyard.

“We’re aware of all the potential competition, and that’s why everything we’re doing here is focused on the future,” Guyot said. “We feel we can compete with a lot of these competitors because we’re a fully integrated resort. The more we can separate ourselves, the better off we are.”

While celebrating Foxwoods' 30th anniversary last month, officials announced the casino had reached an agreement with Great Wolf Resorts, a developer of indoor water park resorts, to open a Mashantucket facility adjacent to Foxwoods in 2024. Also announced were plans for a new high-stakes bingo hall, a 75,000-square-foot convention center and renovations of the casino’s main entrance.

More recently, Foxwoods announced plans to open a new restaurant, Sushi By Bou, and other dining and retail outlets.

MGE’s Pineault said Mohegan Sun has done much to differentiate itself in recent years, mindful of the growing competition it knew was coming. In 2016, with Massachusetts’ first casino on the horizon, Mohegan Sun opened its second hotel, the Earth Tower. It opened its Earth Expo & Convention Center in 2018, several months before MGM Springfield debuted.

During the COVID-19 pandemic, Mohegan Sun opened Tao, a high-end restaurant.

“We’re always looking to add amenities,” Pineault said.

Whatever happens in downstate New York, the region would seem to have reached the saturation point and gone beyond it when it comes to casinos.

“We’re reaching oversaturation in the Northeast,” Barrow said. “That’s why so many are in financial trouble,” including an upstate New York casino that faced having to declare bankruptcy in 2019 and some Atlantic City casinos that struggled amid the pandemic.

“In New York, will adding table games to two casinos downstate grow the pie or cannibalize it?” Pineault said. “The only other one (potential Northeast casino site) on our radar is northern New Jersey. ... That’s always been on our radar.”

In a 2016 referendum, New Jersey voters shot down a proposal to allow casinos, confined in the state to Atlantic City, to two northern counties. One potential site was the Meadowlands complex in East Rutherford, just outside Manhattan.

“New York may force New Jersey to do something yet,” Pineault said.