Do You Have To Pay Tax On Your Casino Winnings In Canada?

Taxes are usually the last thing on your thoughts while you’re betting on a football match or at the poker table. However, it is critical to understand the fundamental tax implications of gambling, especially in no wagering casino Canada. This brief tutorial clarifies whether gambling winnings are taxed as income. Each scenario is distinct, and if you are wagering and believe your earnings may or may not be taxed, you should check with a lawyer.

What Exactly Is Income?

Normally, determining income is a difficult process, but for the sake of gambling, it is considerably easier. Betting revenue will be either a non-taxable windfall gain or taxable business income. To be classed as commercial income, the payer should have had a realistic expectation of profit-driven on their ability, consistency, and aim. Unexpected earnings, on the other hand, are regarded as windfalls. Finally, whether no wagering casino Canada money is classed as income or not is determined by whether the taxpayer anticipated benefiting from their gaming on their best gaming PC or other gadgets.

Even with varied tax rates for taxable prizes, Lottery winnings are not included in your tax-liable wins. Lottery, unlike poker, is regarded as a “pure chance” activity. Poker may need particular knowledge and ability to progress and win several times, hence the tax. However, the lottery is based on chance. The number combos on the draw, and hence the tax exemption, are never known. Furthermore, the only way to boost your odds is to buy additional lottery tickets. In this instance, professional lottery participants are likewise free from incurring taxes on their profits.

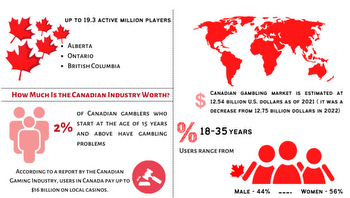

The Gaming Situation in Canada

Casinos in Canada are licensed by provincial officials. Seven out of ten provinces allow some type of gaming. Ontario has at least 25 gaming institutions, making it the province with the most licensed businesses. The Kahnawake National Reserve plays an important role in the country’s gaming sector. While most businesses struggle to obtain a license in the country, businessmen from First Nations Tribes have an easier time opening casinos.

Internationally, the majority of casinos having servers in Canada also have them based on the Kahnawake reserve. This is despite the fact that, except under exceptional circumstances, Canada does not approve remote gambling licenses. Fortunately, the government does not forbid Canadians from playing at international casinos. You may join any internet gambling site and play slots or table games with no fear of government repercussions. And if you win cash, you may keep it without paying taxes. That type of thing does not occur in many nations.

Recreational or Professional Gambling

The Canadian Income Tax Act describes a professional player as someone whose only source of income or livelihood is gaming. This person employs their expertise on a gaming platform to generate long-term income or profit. The Income Act is why poker enthusiasts and specialists become professionals while participating in professional gaming events such as the Poker World Tour. Professional bettors make the majority of their money by playing a game of chance or luck, both online and offline. Anyone earning such a salary is required by the government to pay taxes. It is also the cause why gaming establishments must plan and report their revenues for tax purposes!

The participants in the activity for amusement reasons are free from the tax rule. The government argues that taxing wins would be unkind and unfair to most Canadian gamblers. The fundamental reason is that Canadians play for entertainment or to spend time, and wagering is not a job. As a result, gamers can pay taxes on their property, work possibilities, and any revenue derived from reputable and well-known sources. Even though they are free from taxes, Canadian gamers must declare their gains on the T5 form.

Regional Winnings Tax Regulations

Canada is a large country with many provinces. Each region is a separate entity with its self-governing agencies and gaming regulations. Whether or not you must pay taxes on casino earnings is determined by your location. The age restriction, games available, and other restrictions differ from province to province. Tax rates vary as well. If you are a Canadian who gambles in the United States, you must pay a 30% tax on the casino earnings.

Winnings taxes might sometimes be as much as half of the money gained during your gaming session in different provinces. While playing in the United States, players must report their earnings. When you pay out your winnings, the tax is collected automatically at the cashier. Canadian people lawfully operating in the United States are well off since their losses are deductible.

What Makes a Great Canada Casino?

- Regulation and Licensing. Remote gambling sites, like their physical and mortar counterparts, are regulated. Some of the most renowned digital casino regulators include the United Kingdom, Malta, and Curacao. Gambling platforms are also regulated in Gibraltar, Alderney, and Sweden.

- Fairness and security. When individuals talk about online gambling security, they don’t only mean credentials and data encryption. They also suggest a casino’s privacy practices and how it safeguards its players’ data.

- Providers of games and software. What are your preferred casino games? Make a list of them and only join playing sites that provide such games. Choose your favorite slot games if you’re a frequent slot player. Classic or video slots, brand names, or jackpot games are all options.

- Bonuses for New Customers and Loyalty. Casinos battle for your attention by presenting a variety of incentives. You will earn 10-50 free spins for registering an account. When you place your initial deposit, it is backed 100% with an incentive. Some casinos may provide you spins and stake cash for table games on a weekly basis.

- Banking Alternatives. Casinos that take Canadian money nearly always accept Canadian payment methods. Even if the national money is not accepted for payment, only play at casinos that have friendly banking practices.

Are Gambling Losses Tax Deductible?

According to the Income Tax Act, a Canadian’s liability for paying taxes is to be a professional. However, many people do not understand when the Canadian Revenue Authority identifies an individual bettor as a professional. Only a few situations have a clear-cut line, while others appear muddled. Furthermore, the converse has occurred, with individuals claiming to be professional bettors in order to write off gambling losses. But are wagering losses tax deductible? It might be (Yes and No). Others will argue that it depends if you are a skilled or recreational bettor in Canada.

If you play for the excitement and satisfaction of it, you will suffer losses that are not tax-deductible. However, if you play like a pro and keep track of your games, you might get a tax break when you file your taxes. However, if you have recently paid your taxes, you should consider requesting a tax refund. Furthermore, professionals are freelancers, and unlike other enterprises, professionals can deduct game-related expenditures. For example, tournament costs or other transportation and lodging expenditures!