Developers Secure $2.2 Billion in Financing for Planned Las Vegas Resort

Fontainebleau Project Near Convention Center Among the Largest Underway Along Vegas Strip

Developers of the long-delayed Fontainebleau resort and casino have obtained $2.2 billion in construction financing, putting one of the Las Vegas Strip’s largest development projects on track for planned completion in the fourth quarter of 2023.

Fontainebleau Development President Brett Mufson called the financing a milestone, after his Aventura, Florida-based company and partner Koch Real Estate Investments of Wichita, Kansas, obtained the backing from several lenders led by J.P. Morgan, according to a statement from developers.

“Securing $2.2 billion in financing in today’s market speaks to the widespread confidence in the project, and the team that’s come together to bring it to Las Vegas,” Koch Real Estate President Jacob Francis said in the statement.

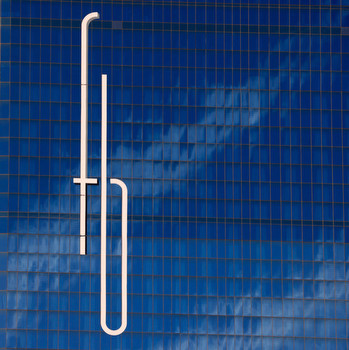

The 67-story resort is under construction on 25 acres at 2755-2777 S. Las Vegas Blvd. on the northern end of the Strip near the Las Vegas Convention Center. Plans include 3,700 hotel rooms, 550,000 square feet of convention and meeting space, and several gambling, dining and retail venues.

In its own statement, New York-based investment firm VICI Properties said it contributed $350 million in mezzanine loan financing toward the project. Developers said other firms involved in the financing included SMBC, Blackstone Real Estate Debt Strategies and Goldman Sachs.

Construction on the Fontainebleau began in February 2007, but the project has since had several stops and restarts because of financial obstacles and changes in ownership, according to local media reports. Current developers acquired the property in February 2021.

The Fontainebleau project is among several under construction or in planning along the Vegas Strip as developers look to capitalize on visitor traffic that has rebounded significantly since the early days of the pandemic. Las Vegas hotel property sales during the past two years have totaled nearly $16.8 billion, representing about 17% of total U.S. hotel sales during that time, according to CoStar data.

“Even with higher labor costs, the strong bottom-line performance of luxury resort properties coupled with asset price appreciation has attracted healthy investor appetite to this asset class, which has garnered a reputation of being almost recession-proof,” Emmy Hise, senior director of hospitality analytics for CoStar Group, said in a report in November.

The Fontainebleau financing group was advised by Dustin Stolly and Jordan Roeschlaub of brokerage Newmark. The resort will be managed on completion by Bowtie Hospitality LLC, a subsidiary of Fontainebleau Development.