Cryptocurrency: Investing or gambling

The New York Times article entitled, “The Puzzle of Low Interest Rates” by George Mankiw, a noted Harvard Professor, discussed the steady decline in interest rates over the past four decades in the U.S. According to the Fischer effect, the drop in inflation expectations resulted due to bond investors’ expectation of high inflation. They anticipate that repayment will be made in significantly less valuable dollars and they demand a higher interest rate to compensate.

Some blame the Federal government since they have the power to set the interest rates at levels that will produce full employment and stable prices. However, the natural rate of interest is not defined by the Central bank but by deeper market forces that govern people’s supply of savings and businesses’ demand for capital.

Another hypothesisis about the rising income inequality over the past few decades.Resources have shifted from poorer households to richer ones. To the extent that the rich have higher propensities to save, more money flows into capital markets and interest rates around the world fall.

The Chinese economy has grown rapidly in recent years, and China has a high saving rate. As this vast pool of savings flows into capital markets, interest rates around the world fall. And lastly, events like the financial crisis of 2008 and the current pandemic are vivid reminders of how uncertain life is and may have increased people’s aversion to risk. Their increased precautionary saving and especially their greater demand for safe assets have drive down interest rates.

With the prevailing low interest rate environment, the millennials and digital natives (Gen Z)are changing the investment landscape with the help of technology. In the search for alternative means of growing their money, they have pushed the growth of crypto currencies, games that let you earn such as Axie and now, even inartworks through NFTs or non-fungible tokens.

Cryptocurrency started at around 2009 through bitcoin. Originally conceived by David Chaum, a cryptographer, as the start of electronic money, payments can be done using a required software to withdraw notes from banks and designate a specific encrypted keys before it can be sent to a recipient. Using blockchain and decentralized finance, a digital currency is untraceable by the issuing bank, the government or third party.

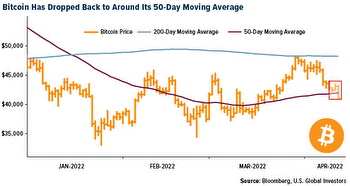

Cryptocurrencymarket investing looks like thestock market with its price trends rising and declining as apparently affected by the law of supply and demand. At present, even traditional financial institutions that formerly ignored cryptocurrency are now taking this asset seriously. The demand at this point is being driven by illiquid accounts. For example, bitcoin is being held by more resilient long-term value investors than traders. Value investors are more likely to weather the storm than sell off their assets during a period of negative price movement.

With the unpredictable economic conditions as well as the pandemic, these factors are pushing a sizeable segment of the investing public to alternative assets like bitcoin as analleged safe store of value uncorrelated to equities market. Even Buttonwood of The Economist recently wrote that a bitcoin, with its poor mathematical correlation with prices of stocks and bonds, makes it an excellent source of diversification using models espoused by Markowitz.

What are NFTs? These are unique assets that can’t be replaced with something else and are verified and stored using a blockchain technology. The craze is around digital artworksthat can be bought and sold on online marketplaces at an auction. The market exceeded in $10 Billion transaction volume as of third quarter of 2021 according to DappRadar that tracks data on crypto-based applications. NFTs are now having its own exhibits and a lot are foreseeing that this will co-exist with other old artforms such as sculpture and paintings.

Axie Infinity is an NFT-based online video game developed by Vietnamese studio Sky Mavis that uses Ethereum based cryptocurrency. It is a trading and battling game that allows players to collect, breed, raise, battle and trade creatures known as “axies”

(digitized NFTs). The game uses a “pay-to-earn” model where participants can earn a token that is traded on Binance as an Ethereum-based cryptocurrency. This allows users to cash-out their tokens every fourteen days. Based on you tube reports, some Filipino families even had this as their source of livelihood during the pandemic.

This piece is not an endorsement of these new investment platforms. Given its attraction, many are blinded, some will probably earn much but there will also be the usual crowd of losers. It is not clear what drives crypto returns except speculation.

Rational investors are willing to take a risk because they expect to earn a risk premium, an expected return more than that on risk free securities. The return from investing in stocks is a share of profits. It is supposed to be a calculated decision based on company fundamentals. What is that equivalent in cryptocurrency? Gamblers take on risk without full calculation of the risk premium, and sometimes from the sheer joy of it. One must always ensure that he understands the scheme before placing hard-earned money into it. The higher the return, the higher the risk.This is the risk return trade-off definition. The adage “if it’s true good to be true, probably it is” should ring a bell.

The Economist wrote that Mr. Gary Gensler, head of the U.S. SEC, said that cryptocurrency markets were rife with fraud, scams and abuse. Britain has banned Binance, a crypto exchange. Regulators around the world are starting to be concerned. To quote Buttonwood, “many investors hold fierce philosophical beliefs about bitcoin – that is either salvation or damnation.”

(Benel Dela Paz Lagua was previously Executive Vice President and Chief Development Officer at the Development Bank of the Philippines. He is an active FINEX member and an advocate of risk-based lending for SMEs. The views expressed herein are his own and does not necessarily reflect the opinion of his office as well as FINEX.)

2021-10-28 06:59:00

["business","columnists","business"]

[2848336,2848778,2848749,2848716,2848700,2848663,2848660]