Crown pushes the share market casino into action

Some say that share markets are just glorified casinos tacked on to the economy so it was probably appropriate that trade in a real-life casino dominated the Australian market on Friday.

Investors in Crown Resorts (ASX: CWN) shares have been doing it tough recently as a welter of inquiries found serious wrongdoing on a fairly widespread scale so confirmation of a higher offer from former suitor Blackstone was music to their ears.

News of the $8.46 billion refreshed offer sent Crown shares zooming upwards from their previous close of $9.90 to finish more than 16% higher at $11.54, which is still a bit shy of the $12.50 a share that Blackstone is offering but is probably a reasonable discount given the likely remaining regulatory dramas.

The main precursor to the renewed bid was the decision by the Victorian royal commission that Crown should keep the licence for its massive Melbourne casino, despite numerous breaches that were described as a “disgrace”, along with a host of other nasty adjectives.

The big question now is whether major 38% shareholder James Packer will be amenable to the offer, with some claims that he will only look at offers that begin above $13 a share but you can understand Blackstone wanting to keep jacking its previous offers up marginally, given the regulatory firestorm.

Blackstone is obviously hopeful this bid might do the trick, with the main condition of the bid being that Crown hangs on to its three casino licences, which now seems likely.

Shareholders will be hoping for the return to the table of Star Entertainment, which is ensnared at the moment in its own regulatory nightmare which is distracting, but is unlikely to prevent it from grabbing a chance to become the dominant monopolistic force in Australian casinos.

Star withdrew its earlier $12 billion merger proposal with Crown in July, citing uncertainty around the casino licences posed by the royal commissions in Victoria and Western Australia.

A bidding war would be the ideal solution for shareholders but obviously may not eventuate.

Banks and miners hold the ASX 200 back

The casino news helped the ASX200 to rise 0.2% or 12.5 points to 7391.7 points but the market still finished lower for the week with slumping prices for the big banks and miners doing the most damage.

However, health, consumer staples and the energy sector were all positive and played their part in the rise.

The Commonwealth Bank (ASX: CBA) managed to chip out the only big bank rise on Friday – up 0.4% – after it caused plenty of drama for the entire sector after reporting shrinking profit margins during the week.

However, that rise was just a bit of a bounce back after the stock declined by a thumping 9.46% to $97.81 over the past week.

Overall, the banks were down 3.6% for the week, with falling prices for the big miners making an overall rise for the market impossible.

Nanosonics growing revenue but not profits

There was some stock specific news that tossed some company shares in both directions.

Medical device sterilising company Nanosonics (ASX: NAN) reported a very similar situation to Commonwealth Bank, telling shareholders that it anticipates a return to double digit revenue growth this year, but warned that profit margins would be lower.

Just like Commonwealth, its shares slumped 5% on that news to $5.80.

Heading in the opposite direction was software supply company Altium (ASX: ALU), which on Thursday told investors it expected strong growth in FY 2022 revenue, underlying EBITDA margin and annualised recurring revenue.

Brokers saluted that news with a rash of buy recommendations and investors jumped on the stock, sending it to a record high of $43.69, up 5.2%.

Treasury Wine Estates (ASX: TWE) also rose for a second day, up 4% to $12.01, as the positive reaction to its $430 million Napa Valley premium wine acquisition continued.

Small cap stock action

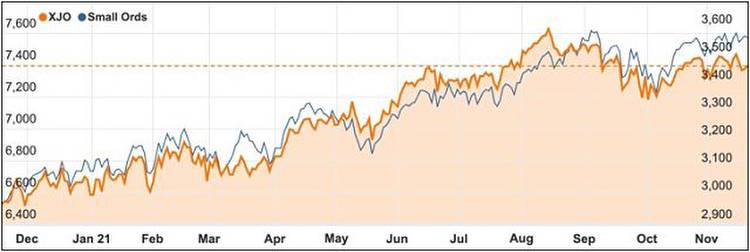

The Small Ords index edged 0.04% higher for the week to close at 3569.0 points.

Small cap companies making headlines this week were:

iCandy Interactive (ASX: ICI)

Lemon Sky has an extensive portfolio of AAA games, meaning games that wield maximal visual and gameplay quality while typically carrying higher development and marketing budgets.

As a means of funding the acquisition, iCandy raised $40 million via an institutional funding round cornered by Animoca Brands and the introduction of some of Australia’s leading long-only funds to its share register.

Spectur (ASX: SP3)

Spectur signed a $1.07 million contract with Optus to enable a multi-year roll-out of its hardware, software and services subscriptions to protect the telco’s remote assets.

The company signed a five-year master supply agreement with Optus’ parent company Singapore Telecommunications (Singtel) as well as a two-year statement of works which operates within the MSA and applies to Optus’ assets across Australia.

Dreadnought Resources (ASX: DRE)

Dreadnought Resources made a high-grade massive sulphide, supergene and oxide discovery at the Orion target within the Tarraji-Yampi nickel-copper-gold project in Western Australia’s West Kimberley region.

Assay results from the first six mineralised follow-up holes drilled at the prospect have confirmed a mix of copper (up to 7.4%), silver (192 g/t), gold (34.2g/t) and cobalt (1.66%), with the mineralisation commencing from 1m under cover and extending to at least 240m along strike and 150m down dip.

Traffic Technologies (ASX: TTI)

Traffic Technologies won a $5.7 million contract to supply Coates with a range of intelligent traffic control equipment comprising electronic signs, radar equipment and associated software.

The orders were awarded to the iTS (Intelligent Traffic Systems) business of Brisbane-based Artcraft Pty Ltd, which was acquired by the company in June.

The new signs are expected to be ready for delivery by mid-next year.

Recharge Metals (ASX: REC)

Newly-listed explorer Recharge Metals reported significant intersections of copper sulphide mineralisation from four holes of a maiden campaign at the flagship Brandy Hill South copper-gold project in Western Australia.

Drilling focused on testing the continuity of mineralisation and extensions along strike, as well as verifying previous assay results over 610 metres of the planned 2,000m reverse circulation campaign.

All four holes intersected thick zones of copper sulphide mineralisation occurring within ultramafic dolerites with quartz veining, with three holes terminating in visual copper mineralisation.

Recharge Metals also applied for an additional exploration licence near to its flagship Brandy Hill South copper-gold project in Western Australia.

The week ahead

It is a middling week for local data releases with business investment and construction work numbers feeding into GDP calculations, which will help analysts to refine their forecasts.

Otherwise, there are consumer confidence numbers, credit and debit card spending, weekly payroll and wage data and retail spending.

Overseas the biggest news is probably the release of the minutes of the US Federal Reserve meeting just before the Thanksgiving Day holiday, which is probably appropriate for anyone with a mortgage.

There may be more detail on the Fed’s decision to start tapering bond purchases, even while leaving the federal funds rate unchanged at 0 to 0.25% in the face of rapidly rising inflation.

Otherwise, there are a range of other indicators including personal income, durable good orders, new home sales, inventories, consumer confidence and trade balance.

Of most interest to an inflation obsessed market will be the Personal Consumption Expenditure numbers, which are closely watched by the Fed and are likely to show prices it covers to be rising at an annualised 4%.