Buy Las Vegas Sands Stock For Long-Term Gains

The shares of Las Vegas Sands have lost 20% since the announcement of the sale of its Vegas property in March. The company remains highly dependent on its Macau business. Macao properties contributed $8.8 billion of $13.7 billion in revenues and $3 billion of $5.2 billion EBITDA in 2019. Las Las Vesta Sands is investing in digital gaming technologies for institutional customers to foray into the online gaming industry.

Sands' H1 2021 revenues declined 66% compared to H2 2019. The company made a $470 million loss. It burned $100 million in the first six months of 2021 compared with $956 million last year. For the full year 2020, the company burned just $1.3 billion in operating activities.

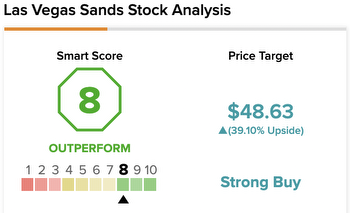

Las Vegas Sands announced the sale of Venetian Las Vegas in March. The company reported a 74% revenue contraction last year. Trefis believes that Las Las Sands stock is poised for long-term gains. The interactive dashboard highlights the historical trends in revenues, earnings, and stock prices of LVS.

In 2019, Las Vegas Sands and MGM Resorts reported $13.7 billion and $12.9 billion of total revenues, respectively. With higher exposure to Macau, Sands’ top-line observed a contraction of 74% y-o-y. MGM has a strong presence in Las Las and other U.S. regions. Its shares are trading 35% above pre-Covid levels. Las Sands shares trading 20% below pre.

Buy Las Vegas Sands Stock For Long-term Gains. Asian portfolio and sports betting entry can generate superior returns. Trefis compares profitability across geographies to highlight strong upside potential in the stock. The interactive dashboard analysis highlights Las Las Sands stock performance during the current crisis and during 2008 recession.

Sands’ Macau, Singapore, and Vegas properties contributed 63%, 22%, and 15% of the $13.7 billion revenues in 2019. Vegas property reported the lowest EBITDA margin of 26%, compared to 54% by Singapore and 36% in Macao.

Sands announced the extension plan of Marina Bay Sands (Singapore property) with a targeted cost of $3.4 billion. The extension project will increase the number of rooms by almost 50% and there are expectations of similar growth in other segments. With a higher capacity, Sands’ EBITDA from Singapore can increase by 50%. Las Vegas Sands stock has strong upside potential from current levels assuming that the company's new investments generate returns comparable to Marina. Bay. Sands has been looking for acquisition targets in Asia.