Billion-Dollar Lawsuit Over Boston Casino a Dubious Bet in 1st Circuit

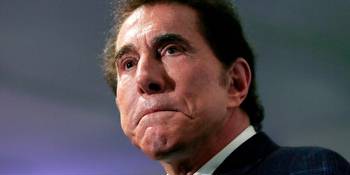

With a rival operator accusing casino mogul Steve Wynn of bribery, forgery and sexual assault, judges appeared to go all in Monday at oral arguments on the issue of standing.

BOSTON (CN) — In a case with billions of dollars at stake and claims of international bribery, political payoffs, shadowy Mafia figures and rampant sexual misconduct, the First Circuit tried Monday to figure out whether Massachusetts gaming officials made a mistake in choosing who should build the Boston area’s only casino.

The battle over the project — a $2.6 billion resort called Encore in the nearby suburb of Everett — has in one corner Steve Wynn, a billionaire Las Vegas casino magnate who ultimately got the license, and in the other Suffolk Downs, a Boston-area horse-racing track that opened in 1935 and had been viewed as the local favorite.

Suffolk sued under federal anti-racketeering law, claiming that Wynn and his company should have been disqualified on the basis of bribery, fraud and other serious misconduct in which they were engaged.

The argument appeared to gain traction Monday as the federal appeals court considered whether Suffolk’s case was properly dismissed in November 2019.

U.S. Circuit Judge David Barron focused on the claim that Wynn and his company “had a way of doing business that’s sufficiently criminal that going forward there’s a high risk that they will continue to affiliate with organized crime figures and hide that.”

“What’s the problem” with calling that a racketeering scheme, Barron wanted to know. “I don’t understand that. I just don’t see why that’s not a reasonable inference.”

Barron, an Obama appointee, pointed to a case where a drug compounding center in Massachusetts caused a meningitis outbreak and officials were indicted under RICO because their way of doing business could cause future harm.

One of the defense lawyers, Aaron Katz of Ropes & Gray in Boston, argued that no other court had ever applied RICO to lying on a casino application and that doing so “would be a radical departure.”

“Why is that a radical departure?” asked Barron, unconvinced.

But Suffolk ran into trouble with the judges because it had partnered with Mohegan Sun, a Connecticut casino, and the application was submitted under Mohegan’s name.

“You’re not the directly injured party,” said U.S. Circuit Judge Sandra Lynch. “You’ve made a foreseeability argument but that doesn’t get you very far.”

“We were directly damaged,” insisted Suffolk’s lawyer, Steven Storch of Storch Byrne in New York.

But U.S. Circuit Judge O. Rogeriee Thompson was skeptical. “How are you different from the people who were going to provide the furniture?” she asked,

“Those people weren’t known to the gaming commission and didn’t have to prove their suitability,” Storch said.

“If the commission didn’t grant either party a license, would you be injured?” asked Thompson, an Obama appointee.

“No,” said Storch, “but we don’t have to rule out everything; we just have to show that we were injured by the other party’s actions.”

Lynch, a Clinton appointee, piled on. She noted that Suffolk had argued that the racketeering scheme involved actions after Wynn got the license, but “once Mohegan is not given the license, how do you have any possible injury regarding their ongoing licensing violations? Doesn’t that eliminate an entire leg of your argument?”

“Mohegan would have gotten the license,” Storch replied.

“Well,” said Lynch, “you’ve given me your answer but I don’t actually think it makes sense.”

Wynn arrived in Boston boasting a long gambling history, having been involved in the Golden Nugget, the Mirage, Treasure Island and the Bellagio in Las Vegas, as well as casinos in Mississippi, Atlantic City and Macau.

As Suffolk tells it, however, Wynn’s success was the result of a long pattern of misconduct including association with mobsters and political corruption. Wynn has also been accused of paying secret settlements to cover up dozens of accusations of sexual assault, which resulted in Massachusetts gaming authorities fining his company $35 million even as they awarded it the right to build the resort.

Suffolk claimed that Wynn’s company lied under oath and submitted falsified documents regarding its knowledge that the toxic former chemical plant site where Encore was built was owned by multiple convicted felons and a reputed Mafia member, which only came to light through an FBI wiretap of a prison conversation in an unrelated investigation.

Suffolk also claimed that Wynn improperly funneled money to the mayor of Everett, Carlo DeMaria, who described the casino project as “tremendous” for the working-class city because “we will no longer be the butt end of Boston.” This was part of a pattern because Wynn also bribed political officials in Macau, Suffolk claimed.

Suffolk had its own troubles in the process. It had to cancel its initial partnership with the company behind Caesars Palace in Las Vegas because of reputed mob ties, and its early plan to site a casino in East Boston was rejected by local voters.

Wynn was named one of the world’s 30 best CEOs by Barron’s in 2011 and was ranked the 17 best-performing CEO in the world by Harvard Business Review in 2014. But he resigned as head of his eponymous company in 2018 amid the sexual misconduct allegations. At the same time he also resigned as finance chair of the Republican National Committee.

A flamboyant art collector, Wynn decorated the Encore resort with a 2,000-pound sculpture of Popeye by artist Jeff Koons that he purchased for $28.2 million.

Sensing a win for Wynn, attorney Joshua Sharp of Nixon Peabody in Boston pressed the argument that Suffolk was not only a derivative party but it didn’t even have a binding contract with Mohegan because the contract was to go into effect only if Mohegan was awarded the license.

As for the fact that Suffolk had to prove its suitability to the gaming commission, “lots of people have to go under regulatory scrutiny,” he said. “Even the card dealers.” If Suffolk can sue, “any party three levels removed could sue, even the card dealers,” he claimed.

Barron asked Storch if he could find a previous RICO case that allowed a derivative party to sue. Storch first cited a Supreme Court case involving tax liens, but Barron corrected him and said the parties in that case weren’t derivative. Then Storch cited two First Circuit decisions.

“No,” interrupted Lynch, “I wrote those decisions, and they did not involve derivative parties.”

“Well, I’m not going to debate you on your interpretation of your own decisions,” Storch said.

“Good idea,” Lynch replied dryly. “Do you have another point?”

But it wasn’t clear if he did because the clerk announced that he had run out of time.