B.C. casinos used foreign high rollers as money-laundering ‘pawns,’ inquiry hears

In 2012, an RCMP investigation reported that Richmond’s River Rock Casino and New Westminster’s Starlight Casino “are a very significant source of money-laundering activity, using wealthy People’s Republic of China gamblers as willing pawns in their activity.”

The confidential RCMP document that makes this explosive allegation — which has not previously been reported on — appears to be the most direct evidence cited in British Columbia’s provincial money-laundering inquiry: that specific B.C. government casinos were “using” foreign high rollers in transnational money-laundering schemes.

This week, on the final days of the two-year Cullen Commission, lawyers representing the federal government cited records, including this “Investigational Planning” document, to counter closing arguments by lawyers representing River Rock owner Great Canadian Gaming and Starlight owner Gateway Casinos.

The RCMP document provides shocking new details about undercover operations targeting high-end patrons and loan sharks operating at the two casinos. And it highlights the thorny questions that commissioner Austin Cullen now must consider in his mammoth task of sifting through some 70,000 pages of evidence and determining which of the commission’s 198 witnesses is telling the truth and whether corruption allowed money laundering to continue in B.C. casinos and real estate investment.

Casino whistle-blower testifies at money laundering inquiryGreat Canadian Gaming lawyers argued there were gaps in police enforcement in B.C. casinos, and that it wasn’t the company’s responsibility to investigate or reject suspicious cash transactions. Instead, the company “appropriately relied upon the RCMP and [Canada’s anti-money laundering agency] Fintrac to provide direction,” lawyer Mark Skwarok argued.

Casino whistle-blower testifies at money laundering inquiryGreat Canadian Gaming lawyers argued there were gaps in police enforcement in B.C. casinos, and that it wasn’t the company’s responsibility to investigate or reject suspicious cash transactions. Instead, the company “appropriately relied upon the RCMP and [Canada’s anti-money laundering agency] Fintrac to provide direction,” lawyer Mark Skwarok argued.He acknowledged the company sometimes erred in obligations to report suspected money-laundering transactions, but claimed “any mistakes that may have occurred were simply the result of human error, rather than the company turning a blind eye to anti-money laundering.”

The company also doesn’t dispute evidence that it often challenged BC Lottery Corporation investigators’ decisions to ban suspicious patrons, Skwarok said. But, he argued, the company was appropriately offering information “that might convince BCLC to take a different approach.”

Any suggestion that Great Canadian broke anti-money laundering regulations to boost revenue and cater to the high-limit baccarat gamblers at the River Rock “has simply not been proven in this hearing,” he added.

Meanwhile, David Gruber, lawyer for Gateway Casinos, argued that evidence regarding casino managers pushing back against anti-money laundering actions referred to Great Canadian, and not Gateway.

Gruber also addressed evidence from the B.C. Gaming Policy and Enforcement Branch’s former director Larry Vander Graaf, in a case that should have resulted in licensing action against Gateway, according to Vander Graaf’s testimony.

Closing submissions underway in B.C. money laundering probe

Closing submissions underway in B.C. money laundering probeIn the 2010 case, Starlight high roller Yu Xiang Zhang walked into the casino and immediately converted $1.2 million worth of casino chips into cash, before asking the managers to provide him a letter saying the money was a legitimate payout.

This was despite the fact, according to the enforcement branch, that upper management knew this gambler obtained cash from known loan sharks, and that an RCMP officer later called the casino’s letter a “get-out-of-jail-free card” that effectively gave the gambler immunity from money-laundering investigations.

But according to Gruber, this case was limited to one occasion under a previous ownership group.

On Tuesday, lawyers for the federal government pointed commissioner Cullen towards two previously confidential RCMP probe documents that detail an undercover surveillance operation on “VIP” high rollers and the loans sharks who supplied them. The records say the probe ran from 2010 to 2012, and a January 2012 case summary says one investigative objective was “to work with our partners towards legislative and/or regulatory change.”

“Tens of millions of dollars in large cash-transactions (many transactions well over $100,000, much of it in $20 bills) are funneled-through several of the larger casinos in B.C on an annual basis,” the case summary goes on to say. “Intelligence has revealed that the origin of much of these funds are derived from criminal activity and are the Proceeds of Crime.”

River Rock and Starlight were targeted in the RCMP investigation, with River Rock taking in the majority of suspected dirty cash, the report says. And both casinos had “groups of loan-shark ‘facilitators’ constantly present in and around the casinos, ready to supply large quantities of cash to these high-roller players.”

“The individuals actually conducting the buy-ins at the casino, and doing the gambling, were wealthy Chinese businessmen, many with little to no ties to Canada,” the RCMP report says. “These high-roller players typically pay-back their losses via bank-deposits in the People’s Republic of China or Hong Kong, which are ultimately brought back to Canada by the loan-sharks (in non-cash form) as ‘legitimate’ money. This is often done by international money-laundering groups.”

The RCMP believed the River Rock and Starlight were using VIPs, including a man named Li Lin Sha, in money laundering, the report says. Other records filed in the inquiry show that Sha completed at least $59 million in suspicious cash buy-ins from 2010 to 2015.

Money laundering commission hears B.C. system is no match for well-organized crime

Money laundering commission hears B.C. system is no match for well-organized crime“There is a great deal of competition between the River Rock and Starlight casinos for Sha’s patronage,” the RCMP’s 2012 “Investigational Planning” report says. “Both casinos actually constructed private gambling salons with this individual in mind.”

The probe also named Yu Zhao, a high roller who, in 10 days in October 2011, bought in for $1.8 million at the River Rock — the majority in $20 bills. Zhao, who was surveilled meeting with a known loan shark, was 26 years old and listed his occupation as CEO of a milk company in China, the RCMP’s report says.

“Surveillance and investigation to-date has shown discrete night-time parking-lot meetings, not far from the casino, where high-roller gamblers have met with these “middle men”, then bought-in at the casino only minutes later with a bag full of cash,” a 2012 summary of the probe’s findings to date said. “To this end, [the RCMP] Integrated Proceeds of Crime [unit] believes that these casinos are a very significant source of money-laundering activity, using the wealthy People’s Republic of China gamblers as willing pawns in their activity.”One of the alleged middlemen was a B.C. politician closely associated with River Rock upper management who “vouched” for the politician, RCMP probe documents say.

The RCMP also believed “the origins of these actual dollar-bills being used can likely be traced-back to drugs, prostitution, or other street-level criminal activities being run and or controlled, by organized criminal groups.”

However, according to Canada’s final arguments in the inquiry, the probe of River Rock and Starlight ended in 2012 for various reasons, including federal police funding pressures and challenges “drawing a concrete link” between cash supplied to the VIPs and the criminal offences believed to have generated the cash.

In a subsequent 2015 investigation called E-Pirate that targeted the same VIPs and loan-sharking networks connected to Mainland China, the RCMP eventually established the link to transnational drug-cash laundering, the inquiry previously heard.

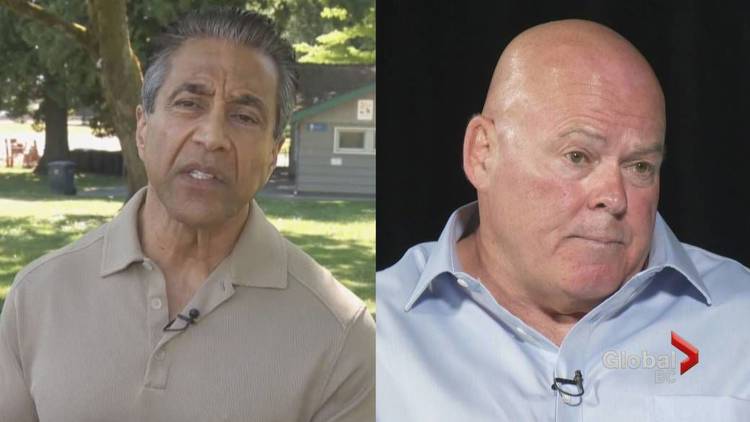

Lawyer Paul Jaffe, representing both former RCMP officer Fred Pinnock and former BC Lottery Corp. anti-money laundering director Ross Alderson, said the men are whistleblowers who didn’t have the legal capacity to question other inquiry participants, and thus were at a disadvantage.

Jaffe argued the “starting point” from Alderson’s testimony is that “everyone” involved in B.C.’s casino industry knew money laundering was occurring.

He pointed to Alderson’s testimony that the BC Lottery Corp.’s board of directors, which claimed that Mainland Chinese VIPs had a “cultural preference” for using cash and therefore should not be discriminated against, had actually privately played a videotape of one high roller staggering into a casino with a heavy bag of cash, putting a humourous soundtrack to the person’s suspicious activity.

Virtually no controls over money laundering in B.C. casinos, commission told“The public know[s] that something terrible has happened in B.C., and that there has been a failure of the institutions in this province to protect the public interest,” Jaffe said. “The public [has] seen the videotapes of hockey bags of cash coming into these casinos. And at the same time, we hear testimony [from other inquiry participants] about robust anti-money laundering going on at the time. But the public is not stupid.”

Virtually no controls over money laundering in B.C. casinos, commission told“The public know[s] that something terrible has happened in B.C., and that there has been a failure of the institutions in this province to protect the public interest,” Jaffe said. “The public [has] seen the videotapes of hockey bags of cash coming into these casinos. And at the same time, we hear testimony [from other inquiry participants] about robust anti-money laundering going on at the time. But the public is not stupid.”Alderson decided to come forward because he believed some B.C. politicians were connected to the casino money-laundering scandal, Jaffe argued, that there were no prosecutions of the gangsters involved, and that thousands of people in B.C. have died from fentanyl trafficking that he believed casino money-laundering facilitated.

And yet, in coming forward, Alderson faced many personal and professional impacts, including anonymous threats, before he was to testify, Jaffe said, citing emails filed as evidence.

“This [email] is a threat to keep his mouth shut, and it’s made by someone who has knowledge of inside events at BCLC,” Jaffe said. “And this [email] is a threat against his family. And he still came forward.”On Tuesday, BC Lottery Corp. lawyer Bill Smart responded to Jaffe, and said the authenticity of the emails cited by Alderson was not proven and that they were not threats.

Jaffe also argued that Pinnock’s testimony, including secret tape recordings Pinnock made with former solicitor-general Kash Heed discussing perceptions of inappropriate relationships between former gaming minister Rich Coleman and senior RCMP officers, were valid evidence that Pinnock and others believed, showed that senior officials turned a blind eye to money laundering.

Heed’s lawyer agreed that Pinnock’s testimony had “concluded” inaction and willful blindness on the part of Coleman and also some senior RCMP officers, had contributed to the fentanyl overdose and casino money-laundering crisis in B.C. However, Pinnock’s evidence was problematic and motivated by personal feelings, Heed’s lawyer argued.

In its closing arguments, B.C.’s largest public employees union alleged that loan-sharking activity continues in B.C. casinos and that casino management favours the needs of high-limit gamblers over the safety of casino workers.

The union said that evidence in the inquiry suggests the B.C. government turned a blind eye to crime in both the casino and real estate sectors, and that “close ties between casino industry and political decision-makers” caused inaction.

“In the face of growing evidence from front-line enforcement staff, law enforcement, and industry regulators, Mr. Coleman and other senior officials chose to promote explanations for suspicious cash transactions that avoided acknowledging the potential of criminal activity in general or money laundering in particular,” the union argued.

“The government’s unwillingness to meet their responsibility to protect the integrity of the gaming industry while aggressively pursuing expansion of the industry and enjoying the resulting revenue windfall mirrors the same government’s reluctance to address the overheated real estate market.”

The union referred to testimony from Barry Baxter, the former RCMP inspector involved in the 2010 undercover probe of the River Rock and Starlight casinos. Baxter went public with his concerns about dirty money in the casinos in 2011, the union said, but Coleman “disregarded Inspector Baxter’s advice — going so far as to publicly discredit Inspector Baxter.”

Whistleblower defends testimony at gambling inquiry

Whistleblower defends testimony at gambling inquiryThe union also pointed to Baxter’s testimony that the B.C. RCMP’s commanding officer, Craig Callens, turned down Baxter’s offer to brief him on the River Rock and Starlight casino probe, and that Callens told Baxter he should “know my audience” rather than speak publicly on B.C. casinos.

In his testimony, Coleman said neither he nor his government turned a blind eye to dirty money.

The inquiry also heard a final statement from the lawyer of Paul King Jin, the alleged organized-crime loan shark named as the top investigation target in BC Lottery Corp. anti-money laundering investigations at the River Rock.

Jin’s counsel, Greg DelBigio, argued that Jin can’t say much because of an ongoing criminal investigation and civil forfeiture cases, but that Cullen should resist arguments that Canada’s Charter of Rights and Freedoms and privacy rights have made it too difficult for Canadian police to investigate money laundering and related crimes.

Cullen is expected to return his final report and recommendations in December.