Are Gambling Winnings Taxed In The Uk?

The FTT case demonstrates why gambling winnings are not subject to UK tax laws, as there is legal support for this position. Taxes on profits are not collected from casinos or betting sites, but from remote gaming operators who are charged 15 percent.

Do I Have To Pay Tax On Gambling Winnings Uk?

Gambling winnings do not have to be taxed, at least in the UK. Any profits or stakes you have won will not be taxable at this location. You need not worry about winning anything smaller than £100 or $1 million. It applies to all kinds of gambling – bingo to slots, to lotteries, to name a few – and even horse racing games.

Do You Have To Declare Gambling Winnings To Hmrc?

If you win small amounts of money, no matter how much it is, and you do not have to give any gambling winnings to the HMRC, then bet tax doesn’t apply to you.

How Much Money Can You Make Gambling Before Paying Taxes Uk?

Because we do not charge taxes on the majority of your winnings and stakes, all your money is kept here without payment of any fees. There is no minimum amount you must play, which means you can win £100 or $1 million every day. In all types of gambling without excluding bingo and poker, including sports wagers, cards, and many others, this does apply.

Is Money Won From Gambling Taxable?

Taxes on gambling winnings will be fully taxable, so you must file a return to prove your winnings. In addition to lottery winnings, raffle draws, horse races, and gaming casinos generate income from gambling. Winning cash and prizes such as cars and vacations are taken into account.

Do Brits Pay Tax On Vegas Winnings?

In addition to 30% withholding tax for foreign national gamblers, they are also subject to 30% income tax, reducing tax treaty tax rates as the winnings are not integrated into American trade and the business operations are not very profitable.

Why Is Gambling Not Taxed In The Uk?

A reason for the UK’s refusal to tax betting is that no revenue is generated. Contributors to Forbes have expressed opinions on their own.

Are Gambling Wins Taxable In Uk?

There is no tax on gambling winnings in the UK at present. The profits of casinos and other online betting sites are instead taxed. The 15% tax is for remote gaming operators.

Do You Have To Declare Casino Winnings Uk?

In The UK, if you bet or win small or large sums, there is no betting tax for you. You don’t have to declare your winnings to HMRC whether or not you’re winning.

How Much Can You Win In Gambling Without Paying Taxes?

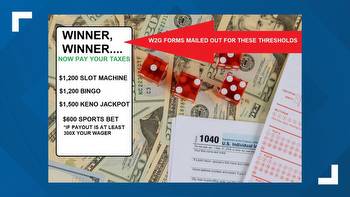

You may get up to $1,200 from bingo or slot machines without having to wager anything. Bets on keno may result in winnings of $1,500 or more (reduced depending on your wager). Play poker (reduced depending on your wager). Taxes paid if an individual wins a lottery or any other lottery.